Biotech Venture Capital - A System Under Stress | Ep. 721

Valuations, Runways, and the Struggle to Graduate

Hello Avatar! Welcome to another week of biotech analysis. Today’s commentary is as always on Thursday focused on the general market update. For the week XBI was UP +2% and remains red at -5% for the year. This week, we dive into the state of venture-backed biotech, where valuation compression, funding bottlenecks, and runway pressure are reshaping the landscape. The frothy days of 2021 are long gone. What we’re seeing now is a system still digesting the excess, with more companies stuck at seed, raising less cash, and burning through it faster. Using new data on graduation rates, revenue multiples, and cash trends, we map out the pressure points, and what they mean for founders, investors, and the road ahead.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

We are also publishing unique content on X - be sure to follow up if you are not already @BowTiedBiotech. And to check-out the archive of our work on X you can find it on our website at: BowtiedBiotech.subtack.com/x-articles.

SUBSCRIBE TO PODCAST HERE:

This Sunday’s Building Biotech strategy discussion will be a fun one which will run through our predictions for potential 2025 M&A / buyouts.

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

BIOTECH PUBLIC MARKET UPDATE

For the week, the public indexes were both UP, with the S&P +3% & DOW moving +2%. For the year both remain UP +7% and +5% respectively. The XBI (the biotech index) comes in UP +2% for the week and remains -5% for the year.

Macro Update: M2, Jobs, and the Biotech Setup

If you’re building biotech exposure heading into 2H 2025, keep your eye on two things: liquidity and the Fed.

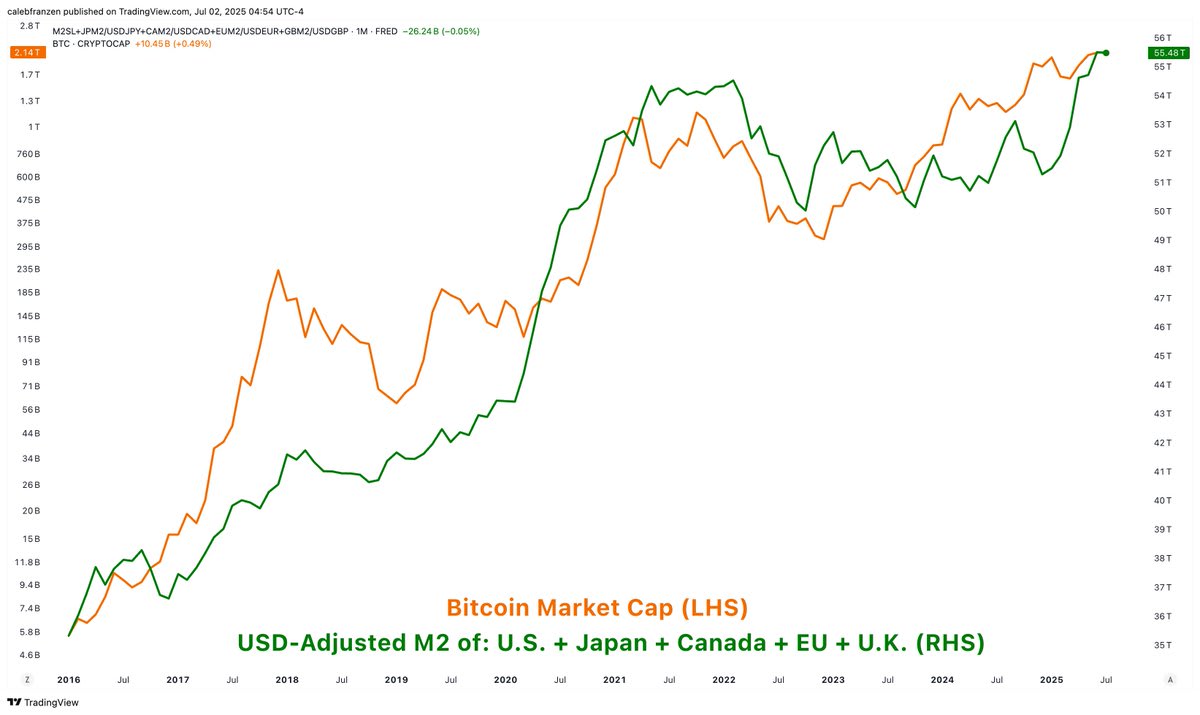

Let’s start with the big one: M2-adjusted liquidity across the U.S., EU, Japan, Canada, and the U.K. just hit a new all-time high. That’s the green line in the first chart. Bitcoin (our XBI risk asset proxy) is sniffing it out already. So is gold. If you’re long biotech, this is the wind at your back.

Meanwhile, the labor market isn’t sending any recession alarms, but it is showing enough softness to keep rate cut probabilities alive:

June added 147k jobs, solid but not hot

Diffusion index (breadth of job gains) stuck at 50%, a classic pre-slowdown level

Half of new jobs are in government and government-adjacent sectors, which aren’t exactly cyclical growth engines

Cyclically sensitive industries are cooling, particularly in goods and construction

Unemployment sits at 4.12%, rangebound for over a year

The Fed doesn’t need a crash to pivot. It just needs cover. And this jobs report gives it. Expect cut chatter to accelerate into Jackson Hole.

Biotech Implication:

Biotech historically tracks real rates and liquidity growth, not trailing earnings. If USD-adjusted M2 keeps rising and the Fed cuts, capital should rotate into higher-duration assets. That means biotech gets a tailwind, especially small caps and early clinical names that depend on access to capital markets.

We’re not calling a new bull market yet. But the macro setup is slowly turning from headwind to neutral, and possibly tailwind by Q4. That shift in liquidity regime is your cue to be early.

TLDR: M2 is making new highs. The jobs report gave the Fed just enough softness to stay dovish. Biotech loves falling real rates. Start positioning.

Enough with the macro, we will now we shift exclusively to capital markets. Many of the figures we will share come from a recent SVB Report - State of the Markets H1 2025, we encourage you to check it out in its full length as we only sample of a portion of the content.

Multiples Follow the Money

Simple supply and demand models go a long way in describing the current state of the innovation economy.

The pandemic boom flooded startups with capital and kept fundraising needs low. As demand dipped, supply surged, pushing up valuations and inflating revenue multiples.

But by 2022, the pendulum swung the other way: more startups needed capital just as VC fundraising slowed. Multiples fell fast, and they haven’t really recovered.

This chart above shows how the spread between capital supply and demand drives valuation multiples.

When supply overwhelmed demand, multiples soared. Now that balance is gone, valuations have reset lower.

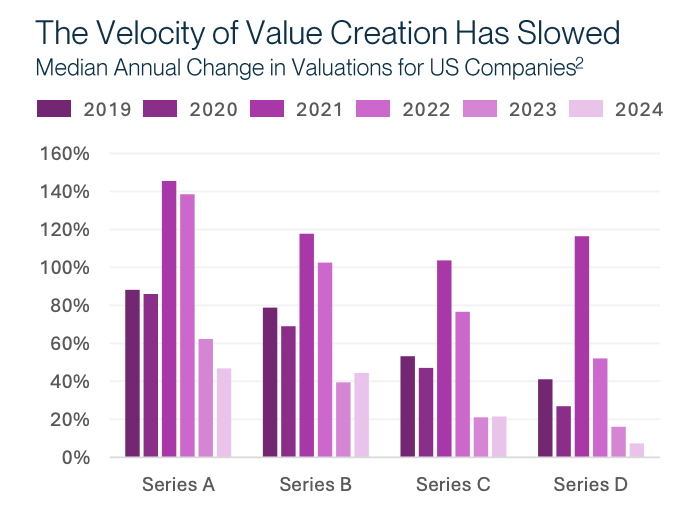

What’s more telling than absolute valuation levels is the velocity of value creation. Series A startups used to double their valuation in a year. Now it takes more than twice as long.

Some of that is market environment, but some of it is real. Growth has slowed. Efficiency is in, but high-multiple investing still wants momentum. Without it, multiples compress.

Below shows the sharp decline in value acceleration across all stages, particularly post-2021. Any of you living in the private markets are aware of this, its nice to see the data support what we see on the ground.

The Series A Bottleneck

Seed Extensions Rise, But Graduations Stall

2021 was the year of bloated seed rounds and premature valuations. Now we’re watching the digestion process.

Seed extension rounds, bridge financings to nowhere, are at all-time highs. They’re a symptom of a congested system.

Too many companies raised seed checks in frothy times, and too few are ready for a true Series A under today’s scrutiny.

What used to be a clear funnel is now clogged. Extensions outpace graduations. The class of 2021 is still stuck, and 2024 is shaping up even worse.

There are structural reasons here. The 2020–2021 seed class wasn’t built for capital efficiency. Series A expectations are higher now, both in terms of metrics and milestones. Rather than fail fast, many companies are opting to extend, preserve optionality, and hope the Series A bar gets lower, or they get higher. Until this backlog clears, the system remains stuck.

A Runway Crisis, Not Just a Valuation One

Cash is the limiting reagent in the venture equation. And right now, startups don’t have enough of it.

Median cash runway in 2024 is 12 months, the lowest since 2019. And it’s not just an average story. 61% of companies saw their runway shrink year-over-year, the second-highest level on record. Burn is real. And it’s accelerating.

Monday we are going to have a special analysis for you of the public markets where we overlay cash position with key catalysts. Depending on if the company needs to raise or not it sets up interesting dynamics to trade around. Be sure to subscribe if you are not already - this is going to be a nice road map for how to trade the 2H of the year.

The shape of the cash burn curve has changed, shorter runways dominate. Startups are surviving, not thriving.

Even those that successfully raise are getting less bang for their buck. Median raise translates into fewer months of runway than any time in the past five years. Some of that is because round sizes are smaller. But burn is also higher, and growth is harder. We’re seeing a compounding effect.

This is the steepest drop in median runway raised since the pandemic. Companies at the 25th percentile are barely scraping 5–6 months.

And it’s not getting easier. Over 50% of startups will need to raise in the next 12 months. If capital doesn’t return fast, and selectively it could get messy.

Financial Fragility Is Spreading

A tough fundraising market doesn’t just delay growth, it forces triage. Some companies have turned to debt, but that lifeline is fraying. Troubled debt deals rose sharply in 2023, and while they’ve dipped since the peak, they remain elevated.

The trendline is up and to the right. Restructuring is no longer a rare path, it’s becoming the default for weak performers.

And when startups do sell, they’re doing it with far less runway. The median time to acquisition is now under six months of cash left. More and more companies are being acquired not because they’re strategic fits, but because they’re out of options. And this is why deal comp multiples are shrinking, its simply a buyers market.

Again, runway at purchase has collapsed. It’s a sign that founders are hanging on as long as they can, until they can’t.

The lack of disclosed valuations in M&A is another signal. Startups are being acquired for less than they raised. These aren’t triumphant exits, they’re soft landings. The kind where you lose altitude, but not everything.

CONCLUSION

This week’s newsletter mapped the slow unwinding of biotech’s venture cycle. Valuations are lower and slower to grow, seed companies are piling into extensions instead of graduating, and cash runways are thinning out just as more startups face the need to raise. The system is under stress, not collapsing, but recalibrating. As capital remains selective, and benchmarks rise, resilience and discipline are no longer optional. Founders must adapt, investors must reprice risk, and everyone should brace for a longer, more unforgiving climb. Despite this we remain optimistic. Much of the data shared today is lagging. In our view valuations have largely reset and the majority of low quality has washed out of the system. We may very well be at the bottom.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

SUBSCRIBE TO PODCAST HERE:

Sundays and Mondays are under the paid umbrella, everything else is FREE. It is $5/month and we encourage you to support our efforts. It is less than 1 cup coffee these days and keeps us motivated to keep producing the hybrid science and business biotech focused content you will not find anywhere else all in the same place.

As a reminder, if looking to go deeper into the topics we cover check out our website BowTiedBiotech.com, or DM us on twitter, or email us: bowtiedbiotech@gmail.com

ABOUT BOWTIEDBIOTECH

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

DISCLAIMER

None of this is to be deemed legal or financial advice of any kind. All updates are sourced from publicly available disclosures. Insights are *opinions* written by an anonymous cartoon/scientist/investor.