Welcome to the 87 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,580 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we wanted to spend some time running through Bruce Booth’s year end summary. It is truly one of our favorites and something we look forward to wrap up each calendar year. This year’s analysis lived up to standards and offers a number of excellent and unique takes on where the market stands and where it is headed. We will take you through all of it along with our commentary. It is important to pause and reflect on the current state of the industry because you truly cannot plan properly for where you are headed if you do not understand where you are coming from.

We are now publishing 4-5x per week according to the following cadence:

Mondays: BioBucks: Stock Analysis & Biotech Catalysts

Wednesdays: CRISPR Corner: Monthly gene editing news (monthly)

Thursdays: Insiders Track: Public & Private Biotech Markets

Fridays: Sweat Equity: Your Weekly Biotech Fix

Sundays: Building Biotech: Strategic Topics

This Monday we are going to skip Monday’s Biobucks column in observation of MLK day/ However, stick with us as we see a handful of volatility setups forming for the early February timeframe. These include: $RARE $FDMT $DNLI - stay tuned over the coming weeks as we will be going into detail on these setups.

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

YEAR IN REVIEW 2023

Today we cover the 2023 Atlas Venture Year in Review where VC aficionado Bruce Booth takes us through the current state of Biopharma Innovation, Market Dynamics, and the Venture Ecosystem. For those of you looking for the full-length discussion (~45 minutes) it can be found here. For those of you looking for the 10 minute summary, keep reading!

REDEFINING “BIG PHARMA”

Booth opens by commenting on what we are all witnessing, the shifting of the big pharma business model. Specifically toward large market opportunities like obesity, metabolic diseases, and Alzheimer's. We have commented in the past on this shift, it is clearly linked to the difficulties in driving growth once the size of these organizations becomes too large. We will have much more to say about this in an upcoming Sunday column.

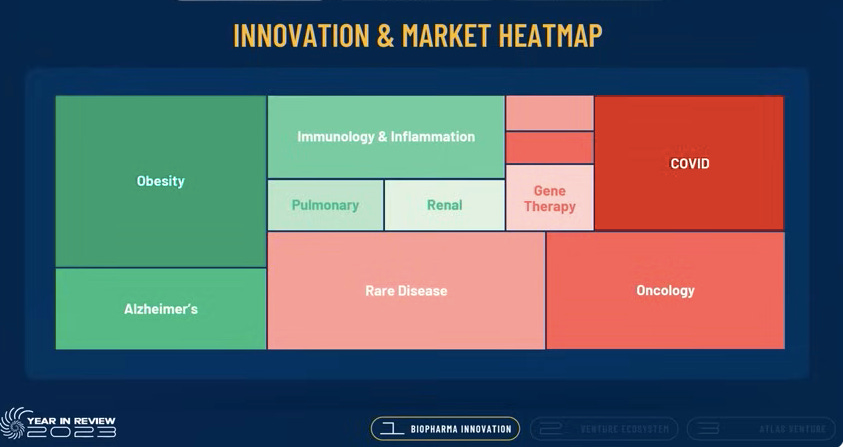

Booth introduces the innovation heat map below which represents market opportunities and whether they are expected to grow or contract.

Innovation Expanding:

Obesity

Alzheimer’s

I&I

Pulmonary

Renal

Innovation Contacting:

COVID

Rare Disease

Oncology

Gene Therapy

MARKET DYNAMICS: A TALE OF TRIUMPH AND TRIAL

The biopharma landscape also witnessed colossal market cap gains for some companies, predominantly in obesity and neuroscience areas. Conversely, pandemic-driven windfalls have tapered off causing adverse market fluctuations with material impacts on companies like Pfizer and Moderna facing over $200B in collective losses.

NAVIGATING INNOVATION: THERAPEUTIC AREA DEEP DIVES

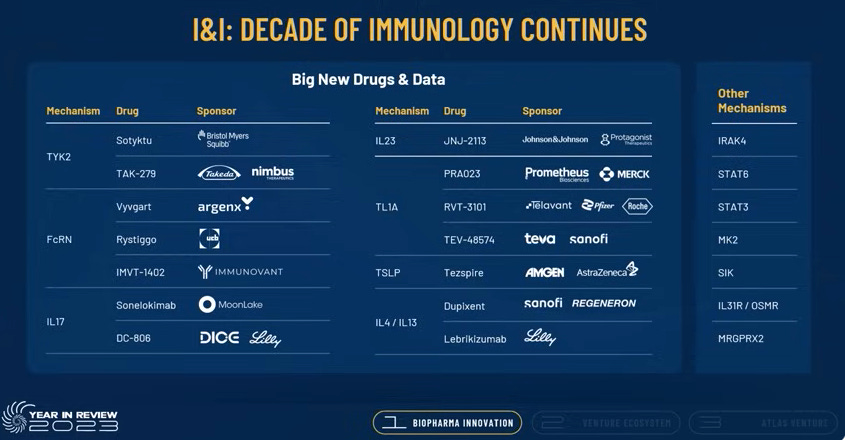

Bruce next drills down into a few specific therapeutic areas, starting with I&I. In 2023 Autoimmune disease research surged with a focus on exciting targets and signaling pathways. In contrast, challenges loomed large in oncology, characterized by transformative breakthrough rarity and overwhelming crowding around certain drug targets.

In the slide below Booth goes into detail on the I&I space calling out the key mechanisms to keep an eye on:

TKY2

FcRN

IL17

IL23

TL1A

TSLP

IL4/13

IRAK4

STAT6

STAT3

MK2

SIK

IL31R / OSHR

MRGPRX2

Shifting to Oncology, Booth notes one of the current challenges in the space is how it has become difficult to observe significant clinical outcomes (particularly monotherapy activity) and when you do it tends to center around a specific target which leads to crowding.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.