Epoch 24: Embracing the Yin and Yang of M&A and Shutdowns

Acquisition & Shutdown Probabilities, Time to $1B Market Cap

Welcome to the 62 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,877 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

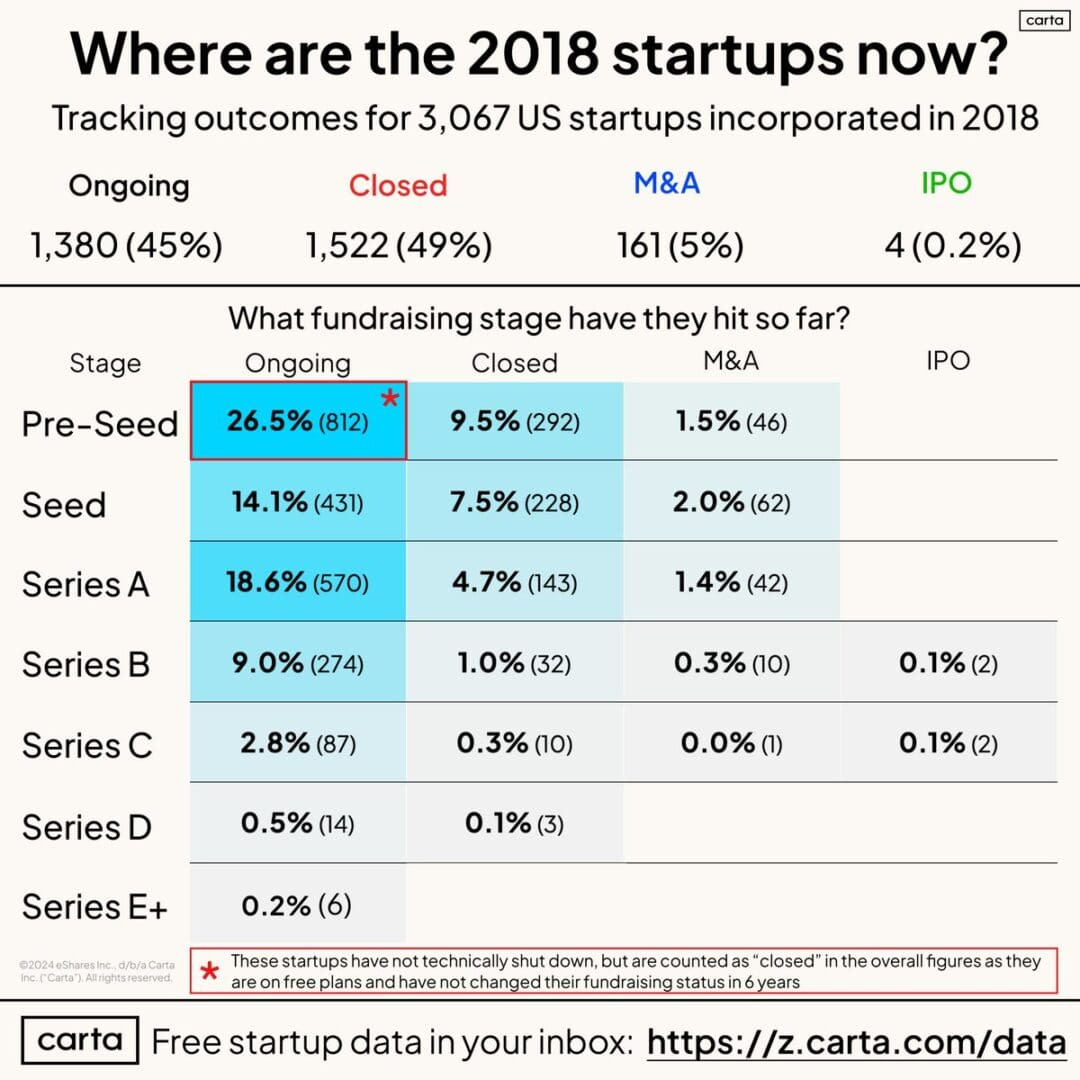

Hello Avatar! Welcome back for another week of biotech analysis. Today is Sunday, which means this is our Building Biotech newsletter that is focused on discussing biopharma strategy topics. Today we are going to cover the dynamic landscape of entrepreneurship. The pursuit of success in startup ventures is often romanticized as a journey of rapid ascension, marked by swift acquisitions or public offerings. However, as we will share, recent insights from Carta, a leading authority on venture capital trends, dispel such illusions, revealing a reality where time and resilience are the true currencies of triumph - deep stuff indeed! We also have data to share around concerning trends in biotech regarding company shutdowns. It’s always put up or shut up in this high stakes game we play, and when the cash runway runs out sometimes it is the end of the road.

If you're not subbed yet click the link above. Every Thursday we are out with our FREE public/private biotech market update. Sundays are the days we focus on forward looking strategy. Monday’s are for public equity research. Tomorrow we will focus on Alnylam Pharmaceuticals who will share topline data from the highly anticipated HELIOS-B study of Amvuttra in TTR-CM. Options pricing suggest 40-50% volatility!

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

Enough shilling for the day, lots to cover this week, let's get started!

The Founder's Marathon: Why Building a Successful Startup Takes Time

Regardless of industry, the startup world thrives on ambition and innovation. Aspiring entrepreneurs dream of explosive growth, lucrative exits, and disrupting entire industries. However, the reality of building a successful startup often falls short of these initial visions.

New data from Carta paints a revealing picture of startup outcomes, particularly within the first five years of founding. Today we dive into this data, highlighting the challenges and opportunities faced by founders on their journeys. Those interested in to read more are encouraged to check out the article which inspired us to tackle this topics: What Are The Odds You Get Acquired Within 5 Years for a Good Price? Around 1%-1.5%.

THE MYTH OF THE QUICK EXIT

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.