Welcome to the 19 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,203 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. If you stuck with us over the past 3 weeks you understand where the market is heading into 2050. If you missed the discussion, the TLDR is that we are heading toward what some refer to as the Algorithm Era - which will be shaped by AI guided personalized medicines. During this transformation the industry is likely to be reshaped. One view is that Big Pharma would slowly shrink and smaller organizations capable of high growth and operating more efficient precision medicine driven R&D and commercial operations will take their place. Tomorrow’s therapeutics driven organizations may very well look more like Big Tech than Big pharma. With that in mind, we wanted to have a close comparison of the two business models and see if there are any learnings to extract which may serve as a guide into 2050.

If you're not subbed - it's $5 a month, the price of a grande! The Thursday market updates will remain FREE and under the paid umbrella. Over the next 3 weeks we will continue to explore the coming integration of techbio with biopharma. Next week we will look more closely at what is happening in AI today. And finally 2 weeks from today we will explore potential company phenotypes for Biopharma 2050. Monday (tomorrow) we are back with public company research on BridegBio ($BBIO) and their upcoming AATR Ph3 data.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Enough shilling for the day, lots to cover this week, let's get started!

TECH VS BIOTECH

Today's analysis will again leverage material from one of the older Torreya/Stifel slide packs. There really was a goldmine of ideas in those decks. We hope that by sharing and building on the conversation we can keep those ideas alive and add value to the initial analysis. Again, the links to the old Torreya site is disabled so unfortunately we cannot share a link to the deck.

The figure below compares Tech to Healthcare, looking at the size of the 5 largest companies compared next to each other in stacked bar format is eye opening. Big pharma is a drop in the bucket compared to Big Tech.

The 5 largest Big Pharma companies are worth a combined $1.9T

The 5 largest Big Tech companies are worth a combined $7.6T!!!

From a product perspective it is the same story.

The iphone produces $196B in sales in a given year vs. say anti-TNF or COVID drugs which produce 20-30B. It's not even close to comparing the scale of these two industries.

How is this? Keep reading…

The average earnings before interest and taxes (EBITA) for Tech is almost 3x larger than for pharma. So we have larger sales, larger products, larger profit, and faster growth for tech. Which industry would you rather invest in? 😀

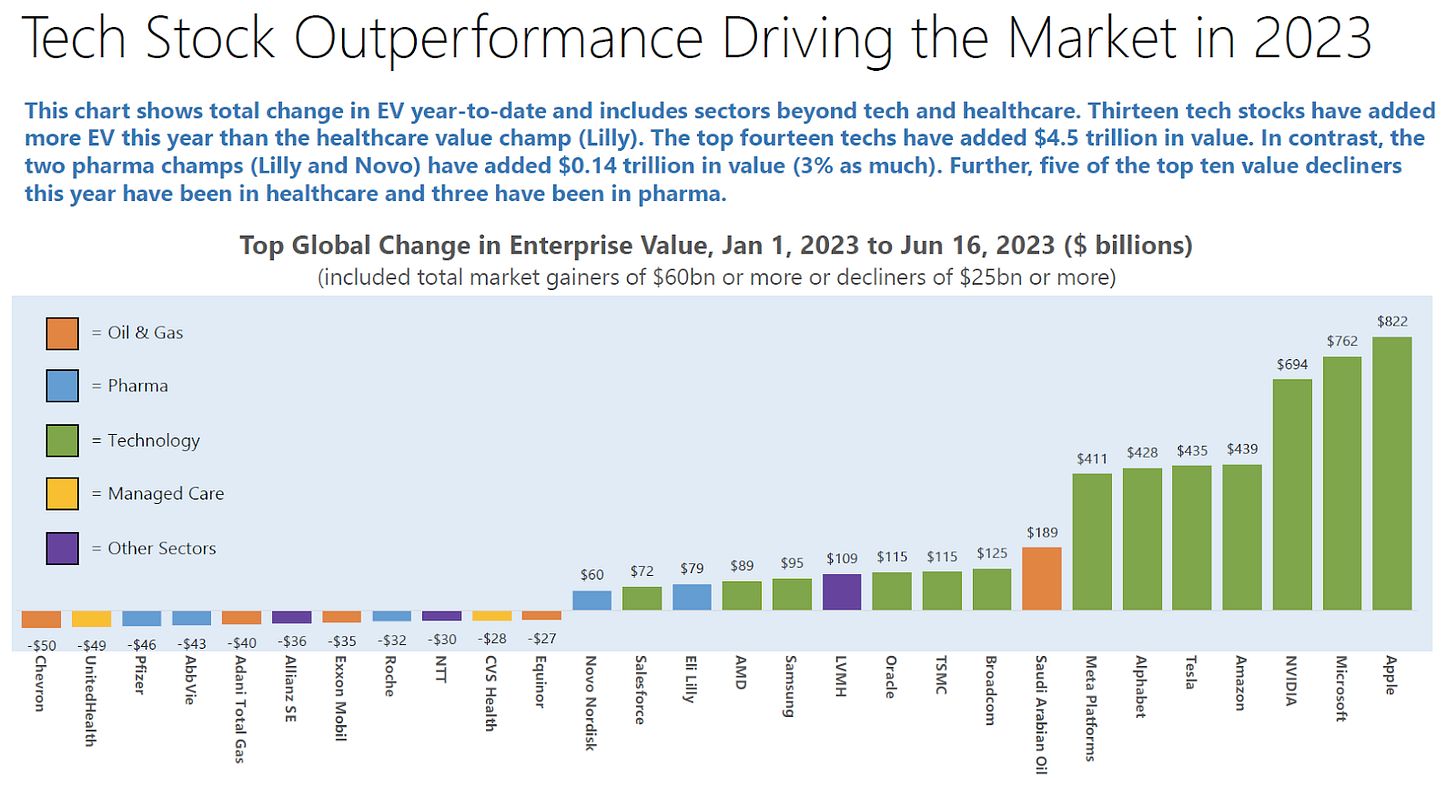

The tweet below from SickEconomics and Paras_Biotech adds additional color on how these industries are simply in different leagues when it comes to scale. Note, both leverage Stifel data - these guys have great analysis! (H/T to the Stifel team).

Below is a blowup of the referenced chart.

WHY IS BIG TECH VALUED 3-4X HIGHER THAN BIG PHARMA?

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.