Epoch 28: AI for Biopharma 2050

Trends, Business Models, Platform vs Product, R&D Applications & Beyond

Welcome to the 17 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 2,018 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we will continue to build on our now 4 week long discussion of the future of Biopharma with a deep dive into Artificial Intelligence (AI). In the investment community AI has quickly become the predominant theme with literally any company claiming to be doing something in this space seeing red hot valuation and attracting strategic partnerships with significant upfront payments. Don’t believe us? Recursion Therapeutics just drew a $50M investment from Nvidia that has everyone talking. Despite this many still question if this is all just hype. This week will go into a bit more detail on how we this rapidly evolving space.

If you're not subbed - it's $5 a month, the price of a grande! The Thursday market updates will remain FREE and under the paid umbrella. Via the Sunday Building Biotech series we have been moving toward the topic of Biopharma 2050. As we will preview today, 2050 will feature a tight integration with AI approaches embedded into biopharma. Monday (tomorrow) we are back with public company research on Homology Medicines ($FIXX) and their upcoming PKU data readout. This one is going to be a HIGH volatility, likely a binary play for those of you that like risk.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Enough shilling for the day, lots to cover this week, let's get started!

AI OVERVIEW

Before diving into AI in biopharma, let's set the stage. There has simply been an explosion in interest in the application of artificial intelligence. It is no longer an abstract and distant concept for the future, it has already permeated numerous aspects of our daily lives. From providing voice and facial recognition capabilities on our handheld devices to revolutionizing the field of biotechnology, AI has become an integral part of many technologies we use today.

Below is a figure which lists the various industries with potential to be touched by this technology. It is important to note, bigger picture, for as exciting as what we are about to describe for healthcare is, it is really a drop in the bucket compared to the aggregate potential across industries.

In the realm of biopharma, AI is slowly but surely carving out a niche for itself. Within drug discovery it is still early days. While there are use cases within research we remain somewhat skeptical. On the drug design side we do see potential for more immediate impact within both chemistry and large molecule design.

In clinical development things are advancing much more rapidly as value creation is more readily apparent. Through the power of machine learning, AI has the ability to handle diverse clinical trial datasets and extract meaningful insights from copious amounts of data. By doing so, AI not only reduces the costs associated with clinical trials but also generates valuable knowledge that can be fed back into the drug development process.

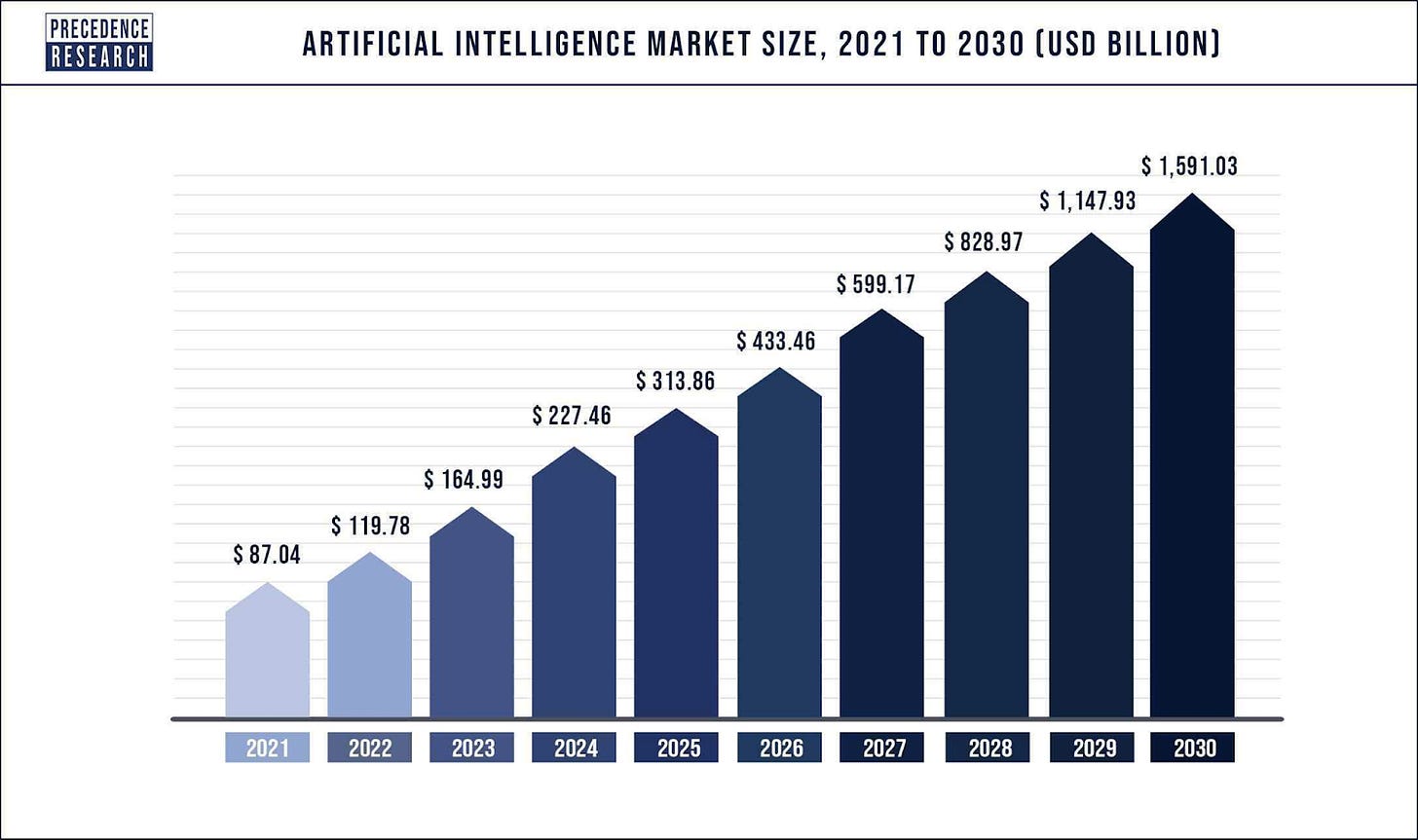

Despite the asymmetry across stages of development in applicability of AI for immediate impact, numerous companies are actively developing AI technologies to cater to the needs of the biotech industry. These services are rapidly becoming indispensable as traditional methods such as classical statistical analysis and manual image scanning reach their practical limitations. AI is paving the way for more efficient and effective biotech practices, revolutionizing the industry and opening new doors for scientific advancements. (see figure below - numbers likely way off, but directionally correct)

AI LIFE SCIENCE APPLICATIONS

The figure below of the TechBio stack below (not sure original source, there are some twitter handles at the bottom right of the figure) will guide today's AI discussion with the primary focus on our sweet spot, research and development - R&D or “Product Development” as shown in the figure. We will first discuss what is happening in the world of research and then advance to discussion around development and beyond.

Just like how biopharma is one drop in the bucket for overall application of AI across industries, R&D is another drop in the smaller bucket for the overall application across biopharma.

AI BIOPHARA UPTAKE TO-DATE

Recently Nature published an interesting review on the state of AI in BioPharma R&D titled: Understanding the company landscape in AI-driven biopharma R&D. It is an interesting quick read with a few informative, quantitative charts we thought useful to share for context setting in terms of size and growth of the growing AI market trend.

First below is a chart of companies formed in the AI space cut by stage of development: R&D, Research, and Development. One will note the number of NEW startups has been declining! We would not have expected this, but the trend does somewhat also track to market conditions.

As one can see in the chart below, the AI companies that are getting financed, and that are already up and running are also attracting eye raising amounts of capital. This is charted below and broken out by capital allocation event. As with therapeutics, mature AI companies are where the action seems to be. Although 30%+ CAGR in the earlier phases is nothing to discount!

Lastly, we thought it useful to share their input dataset for those of you looking to put names behind the numbers. It is always interesting to read through the substrate.

.

.

.

AI THERAPEUTIC DEVELOPMENT BUSINESS MODELS

Below is another interesting figure we came across from Frost & Sullivan. We like it because it nicely outlines into a 4x4 the top TechBio companies focusing on R&D. The x-axis quantitates how advanced each company's internal drug discovery pipeline is. The y-axis is a measure of how focused on computational vs traditional biology each company is.

We can define each quadrant as:

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.