Welcome to the 36 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,238 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we are taking a close look at the concept of herding in biopharma. Herding refers to the phenomena we are currently witnessing where drug targets which appear promising quickly become saturated with intense competition. The PD1 and CD20 spaces serve as poster children for the herding effect. Today we will put numbers behind the extent of this and explore key drivers. The aim of today’s writing is both to acknowledge the herding effect and to also explore strategic planning topics for those of you actively developing novel products in the biopharma space.

We are now operating under a hybrid subscription model where the Sunday update has moved under the paywall - a BIG THANK YOU to those that have joined. The Thursday market update will continue to remain free. The more forward looking content, the insider insights, and market data you need to really assess what is happening in the world of biotech will shift to Sundays.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Enough shilling for the day, lots to cover this week, let's get started!

HERDING AROUND TARGETS

This week we are going to dig deep into a recent (but not new) phenomenon called “herding”. This is the idea that once a target becomes validated the competition becomes incredibly dense as multiple competitors jump in.

No space today better illustrates this than the PD-(L)1 space (also the CD19/20 space). Below is a recent analysis from Cowen of sales in the PD-(L)1 space by agent. The 9 main agents are shown, however there are many more approved and in development.

The pie at the bottom right shows the breakdown of sales projected in 2027 against each other. It is clear Merck (pembro) is the market leader and will continue to go forward.

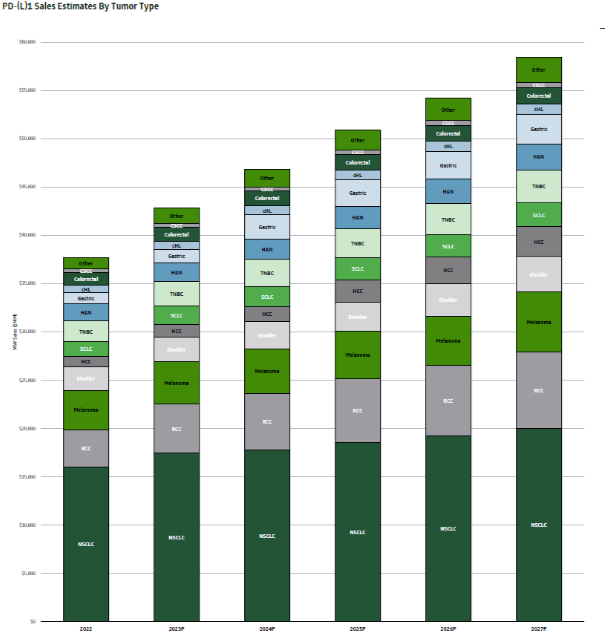

Cowen goes on to cut the market by tumor type for the PD(L1) space. Here we can see lung cancer by far dominates, followed by a handful of other tumor types still be investigated.

We share these figures for an important reason. Without this context one will quickly jump to the conclusion that the space is needlessly saturated. But let's ask ourselves why? There are three answers to that question which jump out to us.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.