Epoch 32: Obesity Therapeutics 2.0 - Next Wave Mechanisms of Action

Your Cheat Sheet for Obesity Therapeutic Development

Hello Avatar! Welcome back for another week of biotech analysis. Today is Sunday, which means this is our Building Biotech newsletter that is focused on discussing biopharma strategy topics. Today we are going to cover Obesity. We promise you will find this one interesting as it will be a light tough on the GLP-1 space with a deeper focus on nexgen mechanisms and how they may fit into a market with generic GLP-1 drugs. We will also highlight upcoming key nexgen MOA data readouts to keep an eye on.

If you're not subbed yet click the link below. Every Thursday we are out with our FREE public/private biotech market update. Sundays are the days we focus on forward looking strategy. Monday’s are for public equity research. Tomorrow we will focus on Jasper Therapeutics is set to share P1b/2a data from briquilimab (c-Kit mAb) for Chronic Spontaneous Urticaria (CSU). With options pricing indicating an astounding 60-90% volatility, the market is bracing for significant movement.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

Enough shilling for the day, lots to cover this week, let's get started!

OBESITY 2.0: WAVE 2 MECHANISMS OF ACTION

The battle against obesity has entered a new era. While traditional approaches have focused on known MOAs such as GLP-1 (Glucagon-Like Peptide-1) and its combinations, the next wave of scientific exploration—Wave 2—promises a broader array of targets and combination therapies. Today we provide an overview of these next-generation MOAs, detailing the scientific basis of each, the companies pioneering these therapies, and the anticipated timeline for clinical readouts.

Wave 1: Established MOAs

Before diving into Wave 2, it's crucial to understand the foundation laid by Wave 1 MOAs, where significant clinical activity is concentrated. These approaches include:

GLP-1: Enhances insulin secretion, inhibits glucagon release, and slows gastric emptying.

GLP-1 + GIP (Gastric Inhibitory Polypeptide): Combines the effects of GLP-1 with GIP, improving insulin sensitivity and further reducing appetite.

GLP-1 + Amylin: Amylin complements GLP-1 by regulating glucose levels and promoting satiety.

GLP-1 + Glucagon: Utilizes glucagon’s role in increasing energy expenditure and fat mobilization.

Amylin: Alone or in combination, amylin regulates postprandial glucose and induces satiety.

CB1 (Cannabinoid Receptor 1): Targets appetite regulation and energy expenditure.

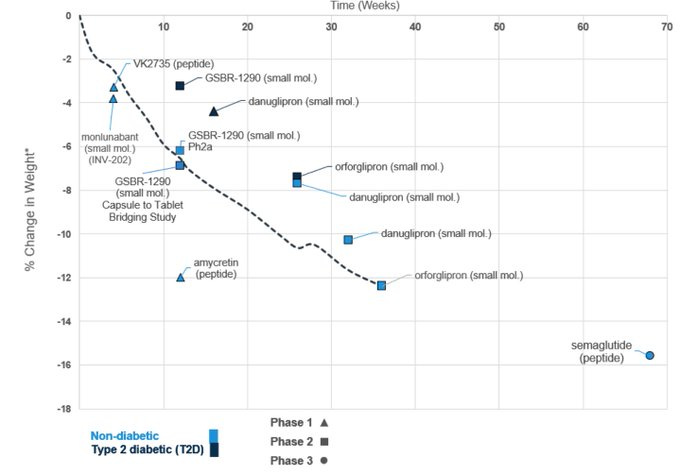

While the injectable GLP-1 market already offers products capable of achieving over 40% weight loss, the pursuit of a convenient oral alternative continues to fuel intense competition. The idea of a simple pill that could eliminate the need for self-injection has captivated both the industry and potential patients, leading to a surge of innovative oral agents currently under investigation. The figure below, sourced from X, vividly illustrates the weight loss outcomes reported at various intervals for different oral candidates, including small molecules such as danuglipron, orforglipron, and GSBR-1290, alongside peptides like semaglutide.

The data highlights that while some oral agents have already achieved double-digit percentage weight loss, others are still navigating the earlier phases of development, each with its own unique balance of efficacy and side-effect profiles. The oral development race faces the ongoing challenge of optimizing the therapeutic index—striking the right balance between maximum efficacy and minimal side effects.

We anticipate that the ideal dosing regimens will be identified through ongoing clinical trials, paving the way for a significant market opportunity. Oral agents that can deliver rapid and sustainable weight loss in the 5-10% range are poised to attract substantial demand, offering a less invasive and highly appealing alternative to injections

Wave 2: Next-Generation MOAs

The second wave of MOAs explores novel combinations and targets beyond the established GLP-1-centric therapies. With 25 MOAs in under investigation we guarantee you had no idea the competition was this saturated. Here are the key MOAs under investigation (some in combo with GLP-1).

1. GLP-1 + GIP + Glucagon

This triple combination aims to harness the benefits of GLP-1 and GIP while leveraging glucagon's ability to increase energy expenditure. GLP-1 enhances insulin secretion and inhibits glucagon release, slowing gastric emptying and reducing appetite. GIP enhances insulin secretion post-meal and plays a role in lipid metabolism. Glucagon increases blood glucose levels by promoting glycogen breakdown and gluconeogenesis in the liver, and it also increases energy expenditure by promoting lipolysis in adipose tissues. The synergy of these three hormones can potentially provide comprehensive metabolic benefits including weight loss, improved glucose control, and increased energy expenditure. Novo Nordisk and Eli Lilly are key players, with clinical readouts expected in late 2024.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.