Epoch 32: Pharma Innovation Sourcing Trends

Capital Allocation Trends, Largest Pharma Buyers, Pharma Pipeline Profiles

Welcome to the 38 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,251 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we are going to explore recent trends in pharma sourcing. End of day the biggest buyer of biotech is pharma, so it makes perfect sense to stay on top of the typical target product profile (TPP) in vogue at the moment. Today we will take you through where biopharma investment dollars are going, which pharma are most active in buying biotech, and which biotech subsegments dominate pharma interest. We will then conclude with an analysis of pharma pipelines and the degree to which they rely on biotech for innovation. This will become quite nuanced down to the modality, therapeutic area, and individual company level of granularity.

If you're not subbed - it's $5 a month, the price of a grande! The Thursday market updates will remain FREE and under the paid umbrella. The Sunday Building Biotech Series is intended to be more forward looking. Monday’s equity research will focus on Immunovant ($IMVT) with their upcoming Ph1 readout in IgG reduction for auto-immune indications.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Enough shilling for the day, lots to cover this week, let's get started!

PHARMA SOURCING TRENDS

Today we will delve into the current landscape of pharma sourcing trends. At its core, the biopharma industry is significantly influenced by the interactions between biotech and pharma, where the latter is often the predominant buyer of the former. As such, it is imperative to stay well-versed in the evolving Target Product Profile (TPP) trends that are currently taking center stage.

We will begin by tracking the allocation of investment dollars within the sector. This is an important metric to monitor, although more of a lagging indicator as investors will build what pharma desires after a clear signal is established. We then pivot our attention to M&A trends, seeking insights from the latest transactions as they offer valuable signals regarding the TPP preferences favored by pharmaceutical giants.

Finally, we conclude today's discussion with a deep dive on innovation sourced externally vs. that developed in-house by pharma companies. We will explore whether any distinguishing features set apart the externally sourced TPPs from their internally nurtured counterparts.

At the end of today's read you will be well versed in the intricate interplay between biotech and pharma as we shed light on the ever-evolving landscape of pharma sourcing.

FOLLOW THE MONEY

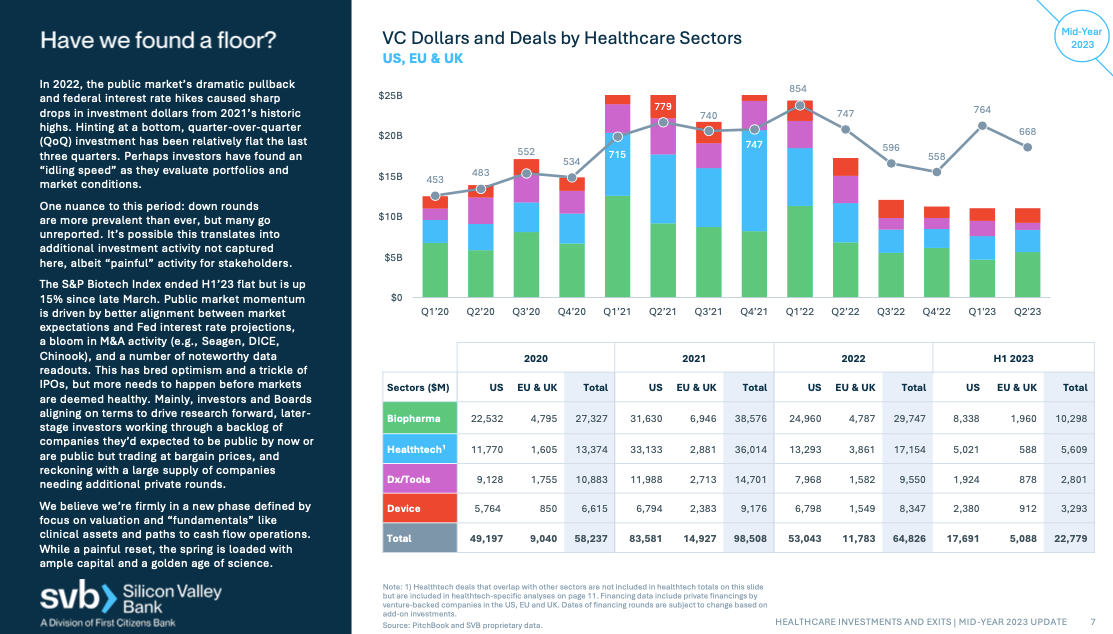

We begin by sharing a recent cut of deal flow data by $$$ from SVB. If you are reading this we would guess you are deep into the biopharma industry and also assume you are aware the recent trend is DOWN in terms of dollars being invested into healthcare.

Healthcare is a broad sector. If we drill down in biopharma (shown in green) we can see the investment trend is unsurprisingly also down since 2020, and that the downtrend is consistent across both the US and EU. Both geographies appear to be getting hit with 50% less investment since the peak in 2021.

Nevertheless investment is happening and it is important to note where it is going. Particularly which therapeutic areas are in or out of favor. Below is data from Stifel which shows investment by therapeutic area (TA) change from the 2021 peak to today. A few things jump out:

CV, I&I are in favor and investment levels are UP in a BIG way

Small indications (e.g., rare diseases) are down as pharma favors large revenues

Emerging modalities DOWN (e.g., degraders, C>, and editing.

Below is the data cut by Lead Asset Therapeutic Area: % change in avg. Enterprise Value of Biotech (Dec 31, 2021 to June 30, 2023)

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.