Hello Avatar! Welcome back for another week of biotech analysis. Today is Sunday, which means this is our Building Biotech newsletter that is focused on discussing biopharma strategy topics. Today, we are going to address a fascinating and forward-looking topic: the origins of big pharma companies. It would be naive to assume that the pharmaceutical landscape of 2030 will resemble today's. Undoubtedly, new big pharma will emerge, and some familiar names may evolve significantly. Our discussion today will analyze this evolution, focusing on the key drivers that enable biotech companies to mature into big pharma. To supplement our discussion, we will examine several case studies.

If you're not subbed yet click the link below. Every Thursday we are out with our FREE public/private biotech market update. Sundays are the days we focus on forward looking strategy. Monday’s are for public equity research.

Tomorrow we will focus on Viridian who is poised to release the much-anticipated Phase 3 data for VRDN-001, an IGF-1R mAb, in active/acute Thyroid Eye Disease (TED). With options pricing reflecting an extraordinary 90% volatility, the market is clearly anticipating significant developments. Make sure this is on your radar—mark your calendars accordingly.

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

Enough shilling for the day, lots to cover this week, let's get started!

The Emerging Titans: Biotech's Journey to Becoming Big Pharma

The landscape of the pharmaceutical industry has been dominated by giants for decades, with companies like Johnson & Johnson, Pfizer, and Roche consistently leading the pack in terms of revenue and global reach. These firms, often referred to as "Big Pharma," have set the gold standard with their extensive portfolios, research capabilities, and international presence. However, the last few years have witnessed a significant shift, with several smaller biopharma firms emerging as potential contenders to join the ranks of these industry titans.

This is not a topic that is new us. Long time BowtiedBiotech readers may recall a past writeup from us on the topic: Epoch 5 2023: Epoch 5: Is Pharma Too Big to Succeed?

The Giants of Today

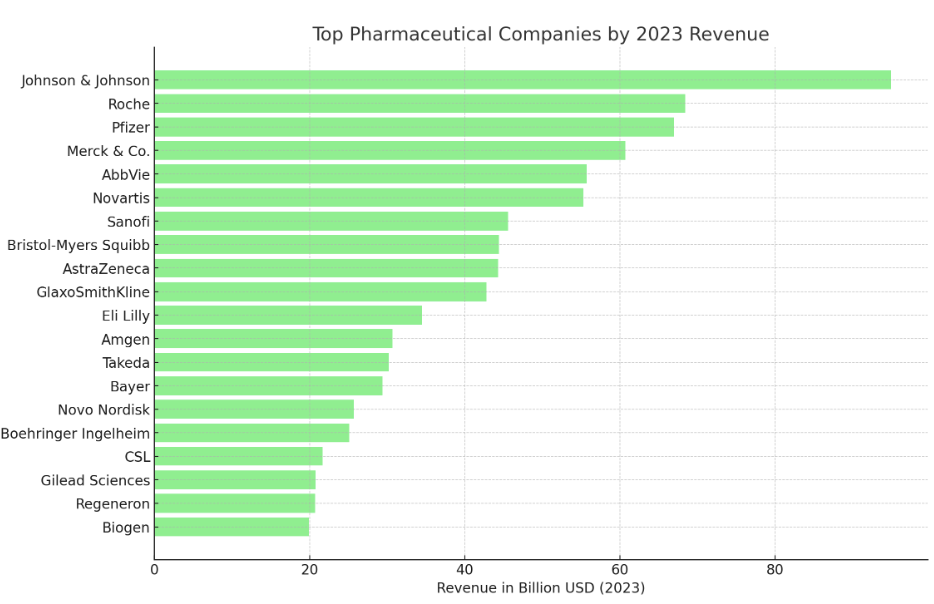

The top 20 biopharma companies by revenue all bring in well over $10 billion annually. Leading the charge in 2023 was Johnson & Johnson, with sales surpassing $85 billion. AstraZeneca—ranking in the top 10 last year with nearly $46 billion in revenue—has set an ambitious target of $80 billion by 2030.

Big Pharma is characterized not just by revenue but also by a substantial global footprint. For instance, Pfizer operates in 150 countries, while Johnson & Johnson extends its reach to over 175 countries. This extensive presence allows these firms to influence global health policies and address health crises on a massive scale.

Last year we wrote about the history of current day Big Pharma - Epoch 24 2023: Epoch 24: BIOPHARMA HISTORY & BEYOND (Part 1 of 3)

The New Contenders

Several biopharma companies are positioning themselves to join the elite group. This includes companies like Regeneron, Vertex, BioNTech, and Moderna as emerging leaders. These firms have demonstrated significant revenue growth, market cap, and the ability to impact global health.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.