Epoch 46: Everything You Need to Understand About Pharma Venture Capital in 2023

Investment Trends, Investment Criteria, Returns

Welcome to the 50 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,414 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we will be digging into corporate venture capital. In the world of biotech these investors are better known as strategics or the venture arms of big pharma. The goals of these entities are a bit different vs traditional institutional venture capital which is largely driven by financial return. Today we will fully unpack how pharma VCs seek and measure strategic return, their role in typical biotech syndicates, and a number of other interesting statistics which will fully characterize their operations. For those of you that may be working in the pharma VC space, we also will briefly touch on common characteristics of pharma VC groups: size, tenure, capital allocation, as well as compensation and retention.

If you're not subbed yet click the link above. Every Thursday we are out with our FREE public/private biotech market update. Sundays are the days we focus on forward looking strategy. Monday’s are for public equity research. Tomorrow we will focus on Aldeyra Therapeutics ($ALDX) with an upcoming approval decision from reproxalap for the treatment of the signs and symptoms of dry eye disease. The options market is projecting a 100%+ move on the news, so it should be interesting!

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Enough shilling for the day, lots to cover this week, let's get started!

CORPORATE VENTURE CAPITAL (AKA PHARMA VC ARMS)

Today we are going to dive into the world of strategic venture capital. Specifically in the biotech world this refers to the VC arms of the big pharma companies. If you missed our previous write-ups on this topic we direct you to:

Feb 2023: Epoch 7: Pharma Venture Capital Remains Steady

Oct 2022: Epoch 43 - EVERYTHING You Need to Understand About BIG Pharma Venture Capital

Today’s discussion will draw from an excellent recent report from Pitchbook: State of CVC 2023: A deep dive into the dynamics of the corporate venture capital (CVC) ecosystem. Those interested to download the full report can do so here.

The figure below is essentially an executive summary, it highlights five key takeaways regarding recent trends in CVC.

Key takeaways:

INVESTMENT: CVC investment peaked in 2021 (same everyone else)

DEAL FLOW: CVC investment criteria for new investments has risen (same everyone else)

EFFICIENCY: CVCs hampered by slow decision-making process (some things do not change)

RETURNS: CVCs aren't just looking for financial returns, strategic return matters.

COMPENSATION: CVC use of carried interest has a meaningful impact on retention (surprise!)

We will run through ~12 key figures we have pulled from the report and provide our commentary. While we encourage you to check out the report in its entirety, after running through our quick analysis you should have a good understanding of the key points.

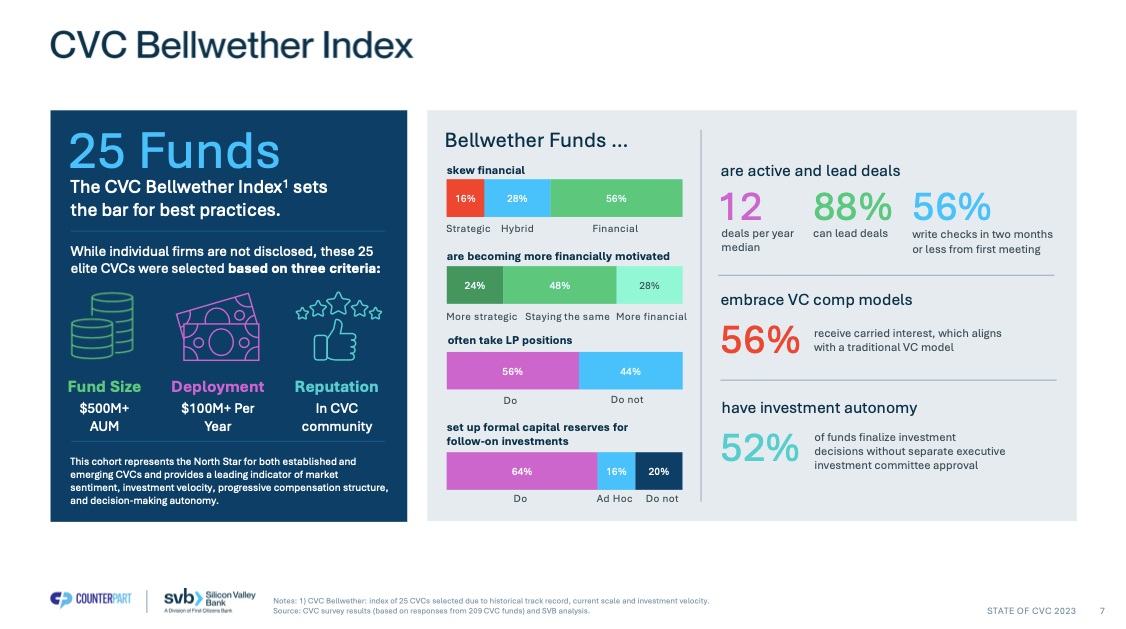

Before getting into the full analysis we would like to define what the Bellwether Index is as you will see it referred to throughout the SVB materials.

A CVC Bellwether is an index of 25 CVCs selected due to historical track record, current scale and investment velocity. So essentially the Bellwether is an index of the biggest funds with the most history. Some interesting take-aways below regarding the Bellwether index:

Average $500M+ AUM (assets under management)

Average $100M+/Yr deployment

Average ~12 new deals/year

88% lead rounds

56% have carried interest

High reputation amongst institutional VCs and entrepreneurs

50% focus purely on financial return, strategic is minority (this is the opposite in pharma)

50% take LP positions

Below is a visual which shows CVC investment investment pace YoY, with most respondents reporting a slower rate of investment. The CVC funds are segmented based on focus defined as strategic, hybrid, financial, bellwether. The decline in activity is observed across all mandates, including bellwether funds, where only 6% of respondents increased their pace of investment in 2023, compared to 77% in 2021.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.