Epoch 5: CV & Obesity Overview - GLP-1 & Beyond

Orals, Gut Hormones, Muscle Preservation, Mitochondria, TGFb family, and more

Welcome to the 43 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,604 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we back with a special deep dive on the red hot CV/Obesity space. If you are investing or building in this space this one is going to be a must read. Today we dive DEEP on Obesity, CV, etc. MOST IMPORTANT - we will take you beyond GLP-1. To conclude there will be a list of actionable catalysts for those of you looking for binary plays or to assemble your own baskets.

If you're not subbed yet click the link below. Every Thursday we are out with our FREE public/private biotech market update. Sundays are the days we focus on forward looking strategy. Monday’s are for public equity research. Tomorrow we will focus on Denali Therapeutics $DNLI with their upcoming Ph1/2 Hunter's Syndrome data. The options market is projecting a 20% move on the news, so it should be interesting!

Please help spread the work by subscribing and hitting the share button if you are enjoying our bi-weekly newsletters!

Lots to cover this week, let's get started!

CARDIOMETABOLIC MARKET

Today’s writeup came from an excellent analysis on the CV space from Guggenheim a few weeks back.

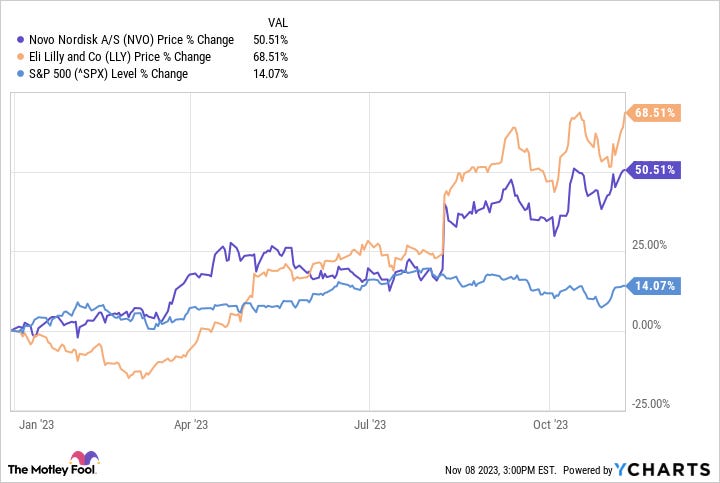

“Since January 1, 2020, the performance of large cap (>$50B market cap) strategic Biopharmaceutical companies has been driven almost entirely by the two leaders in obesity/diabetes, Lilly (LLY) and Novo Nordisk (NOVO). This has catalyzed a "gold rush" of sorts as companies and investors accelerate pursuit of novel gut hormone (e.g.,GLP1, GIP, GCG, PYY, amylin) and lean body mass (LBM; eg. muscle and/or mitochondrial targeting) mechanisms.”

While the obesity space is red hot we see additional momentum building in other pockets of CV - particularly NASH/MASH, and ASCVD.

The NASH/MASH space will see numerous high profile data readouts this year (Intercept OCA, Genfit PPAR, Gilead ASK1, BMS ACC) as well as the rollout of the Madrigal ThB product.

CV in our view is a massive market which continues to fly under the radar. There are a handful of novel mechanisms in advanced development which we feel set this space up to be the next red hot area. These include: lipid-targeting therapeutics (e.g., Lp (a), ANGPTL3, ApoC3, CETP), anti-inflammatory agents (e.g., anti-IL-6), resistant hypertension (e.g., ASI, NPR1), heart failure, TTR-cardiomyopathy, anticoagulation/hemostasis, and rare CV/MET disorders.

OBESITY OVERVIEW

Some key statistics from Guggenheim on the Obesity space:

N = ~30 public/private companies

From 2020 to 2023, # patients in obesity trials grew from ~32,000 to >90,000

>78,000 patients are in or will be recruited into phase 3 studies

>65,000 patients included in LLY/NOVO studies.

Patients in phase 1/2 clinical trials grew

from ~4,700 patients in 52 clinical trials

to ~12,500 patients in 107 clinical trials.

Gut hormone and GLP1-based treatments dominate the clinic

Emerging activity from a number of mechanisms:

Glucagon agonists (BI/ $ZEAL, Altimmune, $LLY, and $MRK) and amylin ($NVO, $ZEAL)

Muscle mass (TGFb family; $LLY, $REGN, $RHHBY, $KROS, $SRRK, $BHVN, and 35Pharma)

Mitochondria (uncoupling, biogenesis, and fatty acid oxidation; led by private companies OrsoBio and Rivus, and $LLY in collaboration with Nimbus).

TGF beta family assets were already in development for the treatment of sarcopenia, other rare muscle-wasting disorders (eg. DMD) or even PAH (eg. sotatercept).

LLY has by far the broadest pipeline of mechanisms and agents in development for the treatment of obesity and its associated disorders.

COMPETITIVE LANDSCAPE: OBESITY

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.