Epoch 50: Biotech Business Models - Platforms vs Assets

Navigating the Landscape of Asset, Platform, and Hybrid Company Builds

Welcome to the 91 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,504 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week, we embark on a critical strategic exploration: dissecting the core of the biotech industry, its business models. Two distinct avenues emerge. The first are product focused companies, typically with high R&D costs but also the upside of blockbuster potential. Examples include biotechs developing targeted cancer treatments or gene therapies. In stark contrast stand platform developers, visionary architects of versatile engines – gene editing tools or AI-powered drug discovery algorithms – enabling diverse applications and rapid iteration through partnerships. Their rewards are smaller, but their canvas of innovation is vast. Selecting the optimal business model depends on a delicate balance: scientific passion, risk tolerance, and resource availability. Join us this week as we delve deeper into this topic, dissecting the nuances and strategic imperatives of each path. Sundays at BowtiedBiotech are not just for rest - join us weekly as we focus on the key strategic issues keeping biotech entrepreneurs and operators up at night.

If you're not subbed yet click the link below. Again, Sunday is the day we focus on forward looking strategy. Next week we are back with an analysis profiling common phenotypes of successful biotech companies. Monday’s equity research will be on Ionis Pharmaceuticals ($IONS) and their upcoming PDUFA date around Eplontersen (AKCEA-TTR-LRx) for treating Transthyretin amyloidosis. The options market projects a ~10% move.

Please help spread the work by subscribing and hitting the share button if you are enjoying our tri-weekly newsletters!

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

Be sure to SUBSCRIBE to not miss.

Enough shilling for the day, lots to cover this week, let's get started!

INTRODUCTION

A few weeks back we read an excellent piece by Elliot Hershberg and Patrick Malone which explored platform biotech models: On biotech platform strategy. We encourage you all to check it out as our thoughts below will be complementary to the framework they have laid out.

If you have been with us for a while you know this is a topic near and dear to our heart and we thought now is a perfect time to revisit these business models.

One trend that has accelerated in 2023 has been the rise of AI and the intersection with biotech. This has manifested into a new area often referred to as techbio. Many of the discovery focused techbio approaches are built out like tech companies, as platforms. However, platforms alone do not really sell so well in biotech which tends to be more product/asset focused.

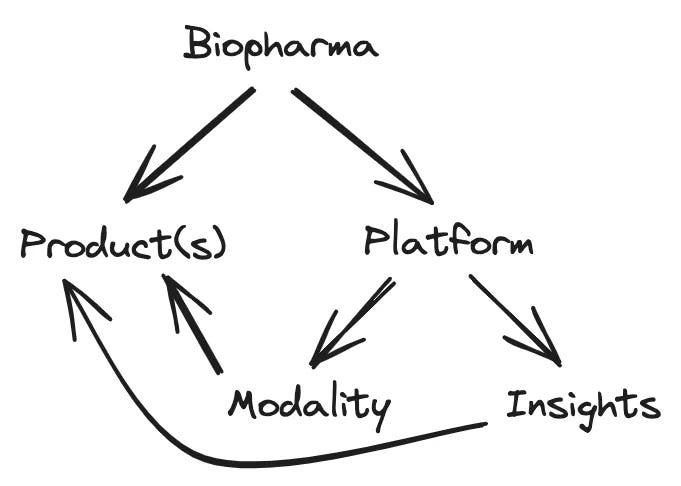

Rather than recreate the wheel we refer you to the Hershberg/Malone figure below for visually depicting these business models as commonly implemented in biotech. Essentially you will have one or the other. A product focused biopharma is self explanatory, they develop assets typically using established modalities (e.g., small molecules and mAbs). The platform build typically features development of innovative technology either in the form of novel modality development (e.g., differentiated gene editors) or is insight generating (e.g., computational systems biology for novel target id). Either way, the platform company will either transition to a product company or fall into the fee-for-service revenue generating model. The paths to commercialization at that point become quite different.

Let’s run through each of these business models and highlight their distinct advantages and challenges. We will then use techbio as a case study to explore paths forward for platform development companies. To conclude we will discuss specifically on how to evaluate platforms and ultimately select the most appropriate model for your venture.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.