Welcome to the 79 NEW Biotech Innovators who have joined us this month! If you haven’t subscribed, join the 1,517 researchers, investors, operators, academics, clinicians and entrepreneurs by subscribing here:

Hello Avatar! Welcome back for another week of biotech analysis. This week we have an interesting essay covering biotech success formulas. Before getting into specifics, we introduce the concept of using market cap as a proxy to measure biotech maturity or stage of development. After understanding the roadmap to success we discuss specific strategies which winning companies implement along their journey. Finally we conclude with a light touch on the current state of the public company universe which is contracting. As you will see this is actually a good thing, and the stage is well set for a productive 2024.

If you're not subbed yet what are you waiting for? Every Thursday we are out with our *FREE public/private biotech market update. Friday’s we have a NEW *FREE newsletter called “Sweat Equity - You Weekly Biotech Fix” which is designed to be consumed as a quick scroll summarizing key stories for the past week. Sundays are the days we focus on biotech strategy, whether you are building your own company or assessing one for investment, these are the tool you need to succeed. Monday’s are for public equity research where we identifying near-term catalysts that come with high projected volatility. Finally on the last Wednesday of every month we will release a *NEW FREE dedicated newsletter called “CRISPR Corner”, which will keep you abreast the latest developments coming from the field.

For this week Monday’s equity research is canceled for the holiday. The holiday schedule can be accessed here. Finally many of you have asked if we will be doing a 2023 recap and 2024 projections - the answer is YES. Look for something on this topic to drop on New Year’s Eve. JPM attendees will also not want to miss our event guide which will highlight all the receptions taking place throughout the week - follow the guide and you may even rub shoulders with us!

Before we get started, one humble ask —your referrals mean the world to us and are the building blocks of our amazing community. Clicking the link below enables sharing of the BowtiedBiotech website via your choice of communication (email, text, socials, etc.). Your support is invaluable, and we can't thank you enough!

NAVIGATING THE BIOTECH HIERARCHY

The ultimate goal for a therapeutic development focused biotech is to deliver novel life changing medicines to patients in need. The end to end journey often involves multiple changes of control in ownership of the originating asset/entity. Generally, the path to patients is via pharma, and many biotech companies exit via M&A to pharma at some point in their journey, typically during clinical development, sometimes during the early revenue ramp of the commercial build.

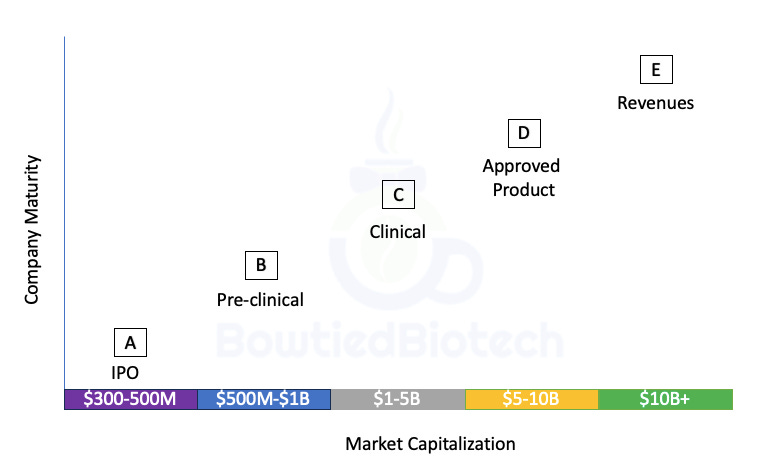

Today we will run through this journey, and use market cap as a proxy for maturity. After understanding common valuation-to-stage of development correlations we will go into detail on key strategic success factors for moving up the valuation/market cap hierarchy. Please note our langue in the previous sentence is very intentional. Specifically the use of the word “strategic” success factors. Technical success can of course be mitigated somewhat, but your odds of success are largely in the hands of mother nature and your hypothesis. Our focus for today will be on strategic decision *YOU can control today.

It's crucial to remember that market cap is not a crystal ball – success in biotech relies on complex interplay of scientific merit, management expertise, and market dynamics. However, understanding this framework empowers builders and investors to make informed preliminary assessments, mitigating risk and identifying promising opportunities within the intricate labyrinth of this high-stakes realm.

Consider today’s reading a run through the key pillars that guide successful navigation in the biotech landscape. We'll explore strategic approaches to M&A, the art of managing investor expectations, navigating the dance of R&D partnerships, and the power of crafting compelling narratives. Our aim is to outline the path for investors and biotech companies alike, empowering them to make informed decisions, embrace calculated risks, and ultimately engineer their own success stories.

MARKET CAP AS A GAUGE OF COMPANY MATURITY

Market capitalization (market cap) can serve as a valuable biotech indicator, offering preliminary insights into a company's stage of maturity and risk profile.

Generally, market cap can be segmented into distinct categories, roughly aligning with a company's progression through the biotech cycle:

Private ($0M-$300M): Early-stage companies focused on preclinical research or development often occupy this range. High-risk, high-reward propositions, their value rests on promising scientific concepts and intellectual property rather than tangible results.

IPO/Public ($300M-$500M): Reaching the public market through an initial public offering (IPO) indicates a shift towards clinical development. Investors value demonstrated progress and early clinical data, often associated with this market cap range.

Preclinical ($500M-$1B): Public preclinical companies close to IND filing, or those with impaired clinical data will often fall in this market cap range.

Public with Proof-of-Concept/Phase 3/Multiple Assets ($1B-$5B): Having achieved proof-of-concept in late-stage trials or possessing a diversified portfolio of promising assets, these companies command higher valuations. They often attract significant investor interest and potential acquisition targets.

M&A or Commercialization ($10B+): Reaching this pinnacle signifies major milestones achieved, be it successful market entry or lucrative mergers and acquisitions. These mature companies boast established products, predictable revenue streams, and a robust market cap.

It is crucial to remember that market cap is not a definitive measure of a company's ultimate success. Several factors, including scientific merit, management expertise, and market dynamics, can influence its trajectory. Nevertheless, understanding the general association between market cap and stage of maturity can be a valuable tool for preliminary assessment and risk mitigation in the biopharmaceutical space.

By employing this framework alongside thorough due diligence and fundamental analysis, investors can gain a more informed perspective on the landscape of potential biotech investments.

KEYS TO UNLOCKING MARKET CAP IN BIOTECH

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.