Hello Avatar! Welcome back for another week of biotech analysis. Today is Sunday, which means this is our Building Biotech newsletter that is focused on discussing biopharma strategy topics. Over the next month we are going to spend our time on Sunday exploring the ex-US state of capital markets, beginning this week with a deep dive into Europe. We will then spend the next three weeks going into depth on what is happening in China. For those of you operating in Europe or evaluating European investments the data we share today will be useful benchmarks for valuation and exit scenario planning.

We are now publishing 7x per week according to the following cadence:

Mondays: Stock Analysis & Biotech Catalysts

Tuesdays: Biotech hot topics (X-article)

Wednesdays: Podcast

Thursdays: Public & Private Biotech Markets

Fridays: Your Weekly Biotech Fix

Saturdays: Podcast

Sundays: Biotech Strategic Topics

We are also publishing unique content on X - be sure to follow up if you are not already @BowTiedBiotech. And to check-out the archive of our work on X you can find it on our website at: BowtiedBiotech.subtack.com/x-articles.

SUBSCRIBE TO PODCAST HERE:

Monday’s BioBucks column will feature Mersana Therapeutics (MRSN) which is nearing a pivotal moment with the upcoming Phase 1 dose escalation data from XMT-1600 B7H4-ADC in various tumor types . Given the high investor anticipation and potential market volatility—possibly resulting in stock price fluctuations of ±100%.

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

EUROPEAN VALUATIONS

The European venture capital landscape has experienced a notable evolution in deal values across different stages of funding. Over the past decade, the emphasis on late-stage VC and venture growth deals has intensified, with median values increasing significantly compared to earlier stages such as seed and pre-seed. This reflects a growing focus on scaling established companies rather than betting on nascent startups. The shift underscores the maturation of the ecosystem, where investors are prioritizing companies with demonstrated traction and a clearer path to returns. Despite this, early-stage VC deals have managed to maintain steady growth, signaling continued support for innovation at the foundational levels. The disparity in funding stages reveals the nuanced risk-return appetite of investors across Europe.

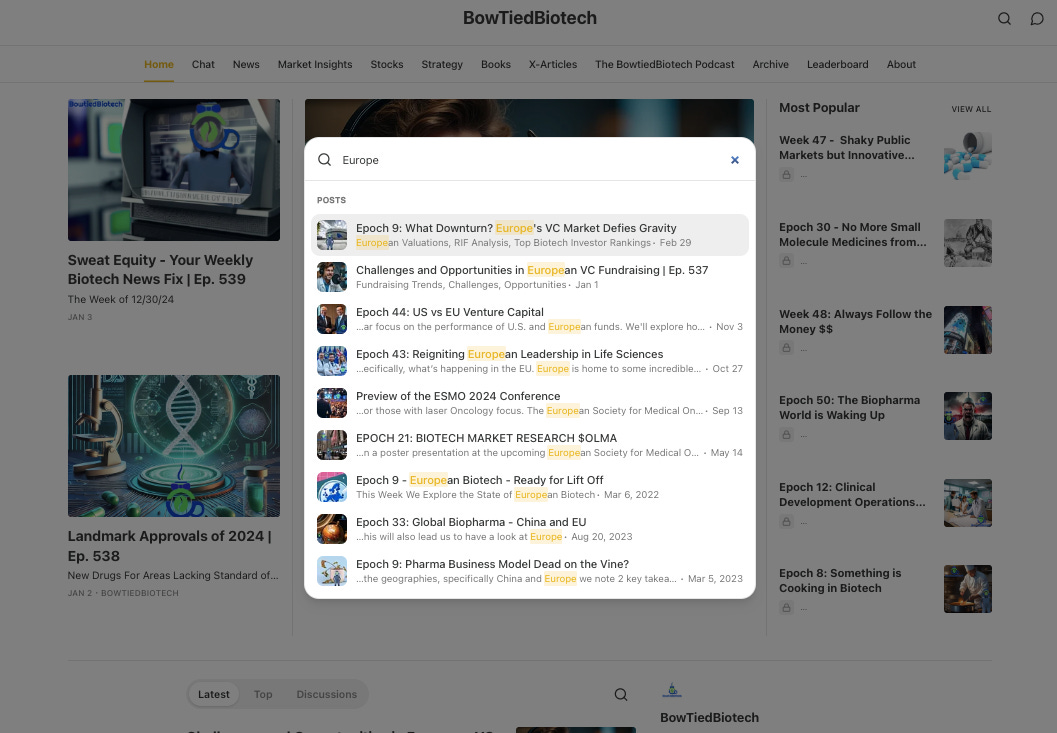

We have previously written in detail on Europe, at the end of today’s newsletter we will include links back to many of the previous BowtiedBiotech write-ups for those of you interested to dig deeper. There is also the search function toward the middle of the page on BowtiedBiotech.substack.com that gives you searchable access to all of our previous content.

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.