BIOTECH MARKET RESEARCH: Cash, Catalysts, and Critical Mass | Ep. 725

How to Trade the 2H Biotech Tape Like a Pro

Today we are going to give you something a bit different. Given we are at the midpoint of 2025 we are going to step back and give you a roadmap for the second half of the year. Rather than profile an individual ticker we are going to leverage recent research on the cash position of individual biotechs and give you a system for the 2H of the year. Next week will be back to our typical format, we will likely go into much more detail on the catalysts mentioned today as their readouts near.

Every Monday we are out with public biotech research, profiling biotech companies with near term catalysts. This will focus primarily on the major market moving biotech events such as data readouts from the major scientific conferences as well as potential regulatory approvals.

We will not offer specific trading advice (and we do not hold any publicly traded biotech equity), but rather flag emerging events that will likely materially drive stock prices (sometimes +/-100% in either direction).

Be sure to SUBSCRIBE to not miss.

HOW TO PLAY BIOTECH APPROVAL/DATA READOUTS ANNOUNCEMENTS

While biotech equities will move on news of announcement, often if there is high conviction in a positive read, a large run up ahead of the news will occur and the actual event turns into a sell the news event. Sometimes, investors wait for the actual event to make a long/short decision. And obviously if the news is disappointing (more often than not) the stock will tank.

This is not financial advice so you will have to make your own call on how to best play these events. Our aim is simply to flag catalysts with high projected volatility.

The Setup

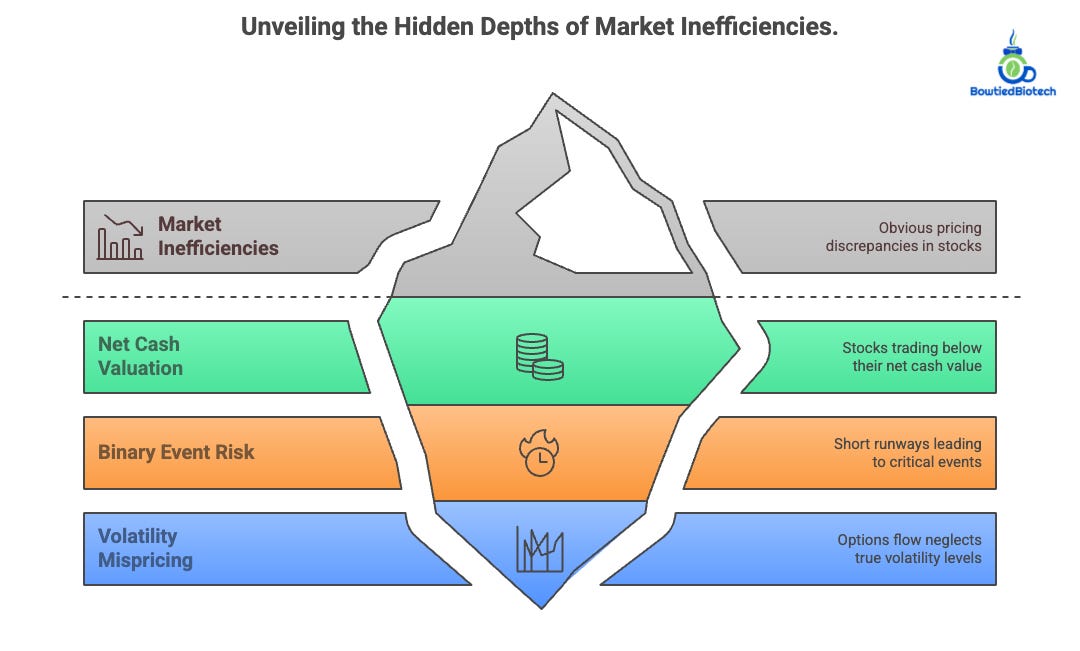

Most investors still treat biotech like a lottery ticket or a science fair project. They chase hype, swing blindly into readouts, or wait for some analyst at a major bank to tell them it’s safe. That’s a mistake.

The edge in biotech has shifted. Some really believe it is all about believing in the science. It’s not. It’s about spotting structural dislocations, places where the setup is mathematically mispriced, regardless of whether the molecule works.

Today’s analysis starts with a Leerink scatterplot (sourced from X) that lays out the cash positions for many biotech companies.

The x-axis maps how many quarters of cash each company has left.

The y-axis shows how far above or below net cash the stock is trading.

From there, we overlaid the real catalyst calendar.

We’re talking more than 180 data events landing in the back half of 2025, dozens of them pivotal.

The signal is clear: if you know what to look for, this is one of the richest catalyst tapes in years.

We filtered it all down with two simple rules:

First, there had to be a meaningful catalyst within six months. Something that forces a repricing: approval, pivotal data, or a lawsuit that resolves binary risk.

Second, the cash had to matter. Either a raise is coming, or the stock is trading so far below cash it’s being ignored.

That’s where opportunity lives, in the blind spots between liquidity, data, and urgency.

Short-Cash, Near-Term Catalyst = Maximum Torque

This is the quadrant where legends are made…or accounts are blown up. These are companies trading at or below net cash with less than four quarters of runway and a binary catalyst on the calendar.

The setup is pure torque - the financial pressure to raise, the clinical pressure to deliver, and the market’s reflex to reprice instantly. When these hit, they don’t grind, they detonate.

But the same math that gives you 3x upside also leaves no floor if the data flops.

That’s why this bucket isn’t for tourists. It’s for operators who understand risk, liquidity, and optionality. And it’s where biotech alpha is born in real time.

Best-in-breed setups:

Keep reading with a 7-day free trial

Subscribe to BowTiedBiotech to keep reading this post and get 7 days of free access to the full post archives.