Scaling Biotech VC Hits a Ceiling | Ep. 728

Why Bigger Checks, Longer Cycles, and Bloated Funds Undermine Returns

Hello Avatar! Welcome to another week of biotech analysis. Today’s commentary is as always on Thursday focused on the general market update. For the week XBI was UP +4% and remains red at -2% for the year. This week, we’re tackling a quiet truth in biotech venture capital that many don’t want to admit: bigger isn’t always better. As funds scale and dollars swell, returns don’t necessarily follow. In fact, the data shows the opposite, larger checks, higher valuations, and longer fund cycles are quietly eroding performance. We walk through the charts, trends, and hidden signals that reveal why scaling a biotech VC platform often caps upside instead of compounding it.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

We are also publishing unique content on X - be sure to follow up if you are not already @BowTiedBiotech. And to check-out the archive of our work on X you can find it on our website at: BowtiedBiotech.subtack.com/x-articles.

SUBSCRIBE TO PODCAST HERE:

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

BIOTECH PUBLIC MARKET UPDATE

For the week, the public indexes were both UP, with the S&P +1% & DOW moving +1%. For the year both remain UP +7% and +6% respectively. The XBI (the biotech index) comes in UP +4% for the week and remains -2% for the year.

Many of the figures we will share today come from a recent SVB Report - State of the Markets H1 2025, we encourage you to check it out in its full length as we only sample of a portion of the content.

Macro Update

Inflation & Interest Rates

The Federal Reserve has made substantial progress in its fight against inflation. By the end of 2024, headline inflation had declined to between 2.5% and 3.0%, a range that aligns closely with the Fed’s long-term target. Consumer surveys indicate that expectations for 2025 remain similarly anchored, reflecting growing confidence that price stability is returning. This shift in sentiment is critical. As shown in the SVB chart titled “Inflation Expectations Track Actual Rates”, the public’s median expectation for future inflation has tracked actual rates closely, and the narrowing of the range between the 25th and 75th percentile suggests more certainty and reduced risk of runaway prices.

With inflation moderating, the Fed began easing in the second half of 2024, delivering 100 basis points of rate cuts. Still, policymakers remain cautious. In his December 2024 speech, Chair Jerome Powell tempered expectations for further cuts, emphasizing that policy would remain data-dependent. The most recent FOMC dot plot reflects this stance, with most committee members projecting the federal funds rate to hold just below 4% through the end of 2025. Interestingly, market participants have priced in a slightly higher rate path, suggesting continued skepticism about the pace of disinflation. The SVB graphic “Market Sees Higher Rate Path than Fed” illustrates this divergence clearly, showing market expectations (in red triangles) consistently above the Fed’s own projections.

Venture Capital in a Post-ZIRP World

While inflation normalization and rate cuts offer hope for investors, venture capital remains in a slow recovery mode. Over the past several years, VC deployment has shown a strong inverse correlation with interest rates. As the Federal Reserve tightened policy aggressively from 2022 to mid-2023, venture activity contracted in lockstep. This relationship is clearly illustrated in the chart titled “Monetary Policy a Key Driver of VC Activity,” which maps quarterly VC deal value against the Fed Funds Rate. Peak investment coincided with zero interest rates, while the subsequent rate hikes to 5.5% triggered a steep decline in activity. As of Q3 2024, investment has started to rebound modestly as rates fall back toward 4.5%.

The reacceleration in deal activity is real, but context matters. This is not a return to the 2021 environment of record-breaking capital deployment, but rather a transition into a more tempered regime. A moderate interest rate environment may resemble 2017–2019, when VC volumes were steady but valuations were less speculative and more milestone-driven. Founders and funders alike are operating with tighter underwriting standards, more scrutiny on burn rates, and greater emphasis on capital efficiency.

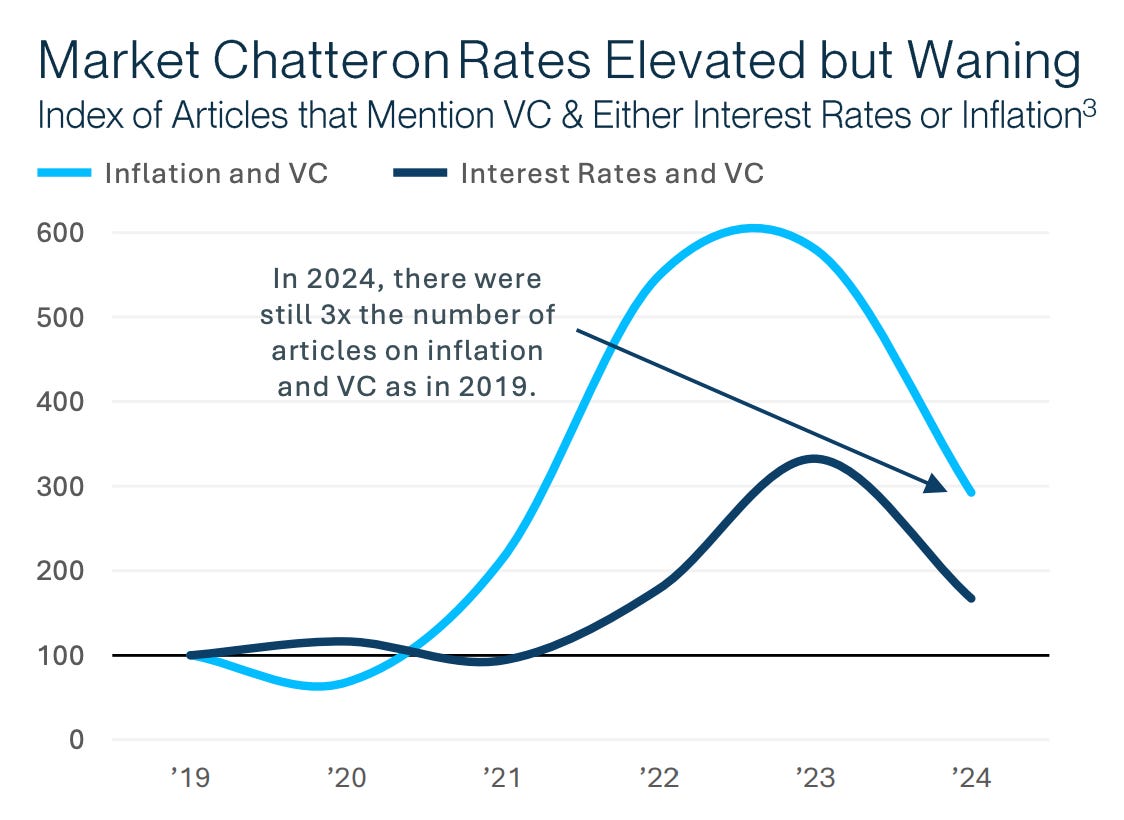

Market chatter also reflects this adjustment. Although VC conversations remain tightly linked to inflation and interest rate dynamics, attention has clearly peaked. The number of articles discussing VC in the context of macro conditions surged in 2022 and 2023, mirroring rate volatility and monetary uncertainty. But in 2024, this chatter began to fade. The chart titled “Market Chatter on Rates Elevated but Waning” shows that mentions of VC alongside inflation or interest rates are still well above pre-pandemic levels, but declining. This suggests that while macro remains a dominant theme, the market is gradually shifting its focus back to fundamentals, execution, and innovation.

As interest rates stabilize, capital may begin to flow more freely, but this cycle will likely reward discipline over hype. Unlike the ZIRP-fueled exuberance of 2021, today’s capital allocators are emphasizing strategic pacing, tighter syndicates, and milestone-based tranches. The cost of capital is no longer negligible, and LPs are prioritizing durable businesses with clear paths to revenue or defensible IP. For startups, this means adapting to a market that values resilience over velocity.

Let’s now shift the discussion directly to biotech markets.

Learnings From 1H 2025 Mega-Rounds

Recent biotech financings in 1H 2025 reveal a capital deployment pattern that’s far from balanced.

According to Endpoints News' summary of mega-rounds, investor behavior is clearly barbelling, with oversized rounds at both ends of the development spectrum.

Early-stage companies like Isomorphic Labs and Tune Therapeutics are raising $150M+ Series A and B rounds, often before human data. At the other end, a thin group of late-phase players are landing $200M+ top-ups to finish pivotal trials. What’s missing is the middle: traditional Series C rounds that fund long, uncertain Phase 1-2a transitions.

The new bias is toward binary outcomes, either big vision or near-term liquidity, not slow, capital-intensive progress.

At the top of the pyramid are a handful of compute-native biology platforms commanding the largest checks of the year. Companies like:

Pathos AI, blending in vivo data with machine learning-driven design;

Insilico Medicine, automating the small molecule discovery loop;

NewLimit, epigenetically reprogramming aging cells with high-throughput screens; and

Eikon Therapeutics, building drug screens off real-time protein tracking in live cells.

These are not one-asset stories. They’re raising capital on the promise of data exhaust, learning loops, and COGS leverage. It’s biotech’s version of foundational models. Investors are no longer just buying a pipeline, they’re underwriting a rate of innovation.

While AI and platform biology dominate the headlines, cardio-metabolic disease is quietly outperforming on average deal size. The anti-obesity halo is real. Companies like Verdive Bio ($411M) and Kardigan ($365M) are pulling capital toward targets in liver, kidney, and cardiovascular disease, even in preclinical or undisclosed stages. Investors are responding to:

GLP-1-driven payer enthusiasm,

clean biomarker-driven endpoints, and

large, reimbursable TAMs that justify big early bets.

A few therapeutic areas are also heating up under the radar:

Ophthalmology is one, with Aviceda, Astena, and SpliceBio each raising >$135M. These programs benefit from short trials, clear regulatory pathways, and high acquirer interest.

Epilepsy is another, with GRIN and Neurona each in Phase 1/2 or 3 and attracting Series D dollars as neuro buyers return to the table.

And across the platform landscape, companies like Tune, GlycoEra, Umoja, and NewLimit reflect a growing appetite for next-generation modalities (e.g., epigenetic tuning, glyco-degraders, in vivo CAR-Ts) that go beyond gene editing and into programmable, multi-pathway biology.

The broader takeaway is that private markets are backstopping the post-SPAC gap.

With IPO windows still narrow, crossover funds are leading private mega-rounds to carry assets through Phase 2, then aim for M&A. Series A and B rounds now account for two-thirds of total capital raised in this cohort. For secondary investors, this shift creates:

longer hold periods,

cleaner cap tables, and

increasing scarcity of high-quality late-stage paper.

It’s a market shaped by conviction on divergence, betting big on what could scale fast, rather than what already looks derisked.

Bigger Isn't Always Smarter

Everyone wants to scale. But in biotech venture, size isn't always an advantage. When funds balloon, so do check sizes, timelines, and expectations. The past five years have been a case study in what happens when VCs chase growth at the expense of discipline.

The result is inefficient burn, distorted incentives, and a generation of funds quietly stuck in mud. Let’s walk through the data and unpack why scaling in this corner of the market often caps upside instead of compounding it.

Bigger Checks, Higher Prices, Same Science

The top 20 VCs are writing meaningfully larger checks than the rest of the market. In Series B and C rounds, these deals have soared well past the median. But more money doesn’t make science better. It just raises the bar for exit.

These large funds are also paying higher valuations across the board. In 2022, median post-money valuation for a Top 20 VC-backed Series C round neared $500M. That’s not a milestone, it’s a liability when public comparables are repricing down.

Worse, it pushes smaller VCs out of the room. Consolidation isn’t just about dollars, it’s about access. And that has long-term consequences for diversity of thought and early-stage experimentation.

More Capital, Less Alpha

The returns don’t lie. Small funds have consistently outperformed large ones on an IRR basis. Since 2000, the median small fund has shown more upside, more variability, and more edge.

Why? Because smaller funds can be more selective. They don’t have to mimic the market to deploy capital. Larger funds, by contrast, become index-like over time. It’s hard to outperform the market when you are the market.

After 2014, most fund returns are still unrealized. But the patterns are already visible: scale dilutes selectivity. And in a hit-driven business like biotech, that’s a death knell for outperformance.

Management Fees Skew Incentives

In large funds, fees become the floor. Over a 10-year cycle, big funds rake in $150M+ in management fees alone. That’s 3x more than small funds.

The problem? That cash flows whether the fund performs or not. Carried interest stays flat, but fixed income goes up. This dulls the incentive to generate true alpha.

Large funds become asset gatherers, not risk takers. The business model shifts from upside to survival. And when that happens, capital goes into safe bets, not bold science.

Fund Cycles Are No Longer 10 Years

Forget the 8-12 year fund cycle myth. The top-performing funds now take 16-20 years to return capital. That means LPs are stuck for nearly two decades before they see liquidity.

As funds get larger and invest later, they slow everything down. Startups stay private longer. Exits get pushed out. And markups on paper don’t pay the bills.

This is why more LPs are starting to ask for updated LPA terms. If capital is going to be locked that long, fees better stop sooner.

Time Between Funds Is Creeping Back Up

In 2021, everyone was raising a new fund every year and a half. Now? It’s back to nearly three years. Deployment is slower, LPs are more cautious, and many funds haven’t come back to market at all.

This stat hides something important: many funds that raised at the peak will never raise again. They’re not dead yet, but they’re fading. Quietly. It’ll take another 10+ years to unwind.

Capital Efficiency Has a Hard Ceiling

Biotech isn’t cloud software. You can’t 5x your fund size and expect to get the same ROI. Why? Because there are limits to what a preclinical or early clinical biotech can absorb productively.

Either you write five times bigger checks (which risks burn bloat), or five times more checks (which dilutes attention and governance). Both dilute performance.

This is where scale turns into sludge. More money chasing the same ideas doesn’t yield more winners, it just crowds the cap table and extends the time-to-exit.

What Breaks the Cycle?

LPs are still chasing brand names. Big VCs are still dominating late-stage syndicates. And no one wants to be the first to downsize.

But the feedback loop is already wobbling. If muted returns become structural, expect LPs to demand change. That could mean:

Smaller, focused funds making a comeback

More GP spinouts under $200M

Secondary sales and continuation funds to unlock stuck capital

The system doesn’t fix itself. It just eventually runs out of excuses.

Scale Carefully or Stagnate

Biotech VC has limits. You can’t brute-force alpha with capital. The firms that forget this are the ones quietly underperforming today, and quietly winding down tomorrow.

If you want to win in this market, stay focused. Stay lean.

And remember: it’s not about how much you raise, it’s about how much you return.

CONCLUSION

Today, we’ve seen how the pursuit of scale, bigger funds, faster deployment, higher valuations, has left many biotech VCs with bloated portfolios, muted returns, and little room to maneuver. The old rules about fund life cycles, check efficiency, and alpha generation still apply. LPs are waking up. GPs are adjusting. And the firms that stay disciplined may be the ones left standing when the dust settles.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

SUBSCRIBE TO PODCAST HERE:

Sundays and Mondays are under the paid umbrella, everything else is FREE. It is $5/month and we encourage you to support our efforts. It is less than 1 cup coffee these days and keeps us motivated to keep producing the hybrid science and business biotech focused content you will not find anywhere else all in the same place.

As a reminder, if looking to go deeper into the topics we cover check out our website BowTiedBiotech.com, or DM us on twitter, or email us: bowtiedbiotech@gmail.com

ABOUT BOWTIEDBIOTECH

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

DISCLAIMER

None of this is to be deemed legal or financial advice of any kind. All updates are sourced from publicly available disclosures. Insights are *opinions* written by an anonymous cartoon/scientist/investor.