Hello Avatar! Welcome to another week of biotech analysis. Today’s commentary is as always on Thursday focused on the general market update. For the week XBI was DOWN -5% and is now red for the year at -2% for the year. We are fresh back from JPM and will give your our 2 cents on what we think the highlights of the conference were. On the macro side of things, it appears inflation is stabilizing, we will outline a few scenarios that could unfold and how each may impact the biotech sector. Drug discovery is always evolving, and 2024 was a standout year for innovation. Antibody-drug conjugates (ADCs) redefined cancer treatment, RNA therapeutics gained momentum, and the competition between CAR-T therapies and T-cell engagers heated up. Emerging modalities like targeted protein degradation (TPD) and next-generation cancer vaccines captured industry and investor interest, while in-vivo CAR-T therapies promised simpler manufacturing and broader patient access. These advancements are shaping the future of medicine, and today we’ll explore the trends, challenges, and key players driving this transformation.

We are now publishing 7x per week according to the following cadence:

Mondays: Stock Analysis & Biotech Catalysts

Tuesdays: Biotech hot topics (X-article)

Wednesdays: Podcast

Thursdays: Public & Private Biotech Markets

Fridays: Your Weekly Biotech Fix

Saturdays: Podcast

Sundays: Biotech Strategic Topics

We are also publishing unique content on X - be sure to follow up if you are not already @BowTiedBiotech. And to check-out the archive of our work on X you can find it on our website at: BowtiedBiotech.subtack.com/x-articles.

SUBSCRIBE TO PODCAST HERE:

This Sunday’s Building Biotech strategy discussion will deliver Part 2 of our 3 part series (which will likely take us through January) on the hot topic China biotech.

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

BIOTECH PUBLIC MARKET UPDATE

For the week, the public indexes were both UP, with the S&P +0.5% & DOW moving +1.5%. For the year both remain UP +1.5% and +1% respectively. The XBI (the biotech index) comes in DOWN -5% for the week and remains -2% for the year.

JPM Update

JPM 2025 is a wrap This week we are going to provide a brief overview of what we saw and heard out in San Fran.

It should be no surprise to you that biotechs need money, the dirty secret is that investors have it. Lots of it actually on the private side. We personally met with most of the blue chip VCs and firms are deploying. The public side appears to be a different story. Bankers are worn out, and deal-making isn’t breaking records. Privates are where the action is, with many companies pitching new differentiated hypotheses. This year, platforms are taking a back seat while assets are driving interest. If you’re fund raising, know where the investor attention is going.

China is the wildcard. Local agents/asset aggregators are moving aggressively to match sellers to buyers. Access to China’s clinical infrastructure is part of many discussions. The BIG question: can companies navigate geopolitics while leveraging those resources? For those chasing deals, it’s a balancing act and important to keep in mind.

M&A chatter is keeping the energy alive. The big headline? J&J’s acquisition of Intercellular for $4.5 billion. It’s a signal that big pharma is still hungry for strategic assets, especially in immunology and inflammation. Deals like this make it clear: innovation that can plug directly into existing pipelines remains a top priority. Investors should watch these trends—who’s buying, who’s selling, and where valuations land. It’s not about volume; it’s about precision.

Lastly, we must emphasize that the streets of SF are making people think twice about safety. Not the best backdrop for one of the most important events of the year. Wen Miami?

Macro Updates

Inflation is stabilizing, but the Fed’s balancing act isn’t over. Today’s 2.9% headline CPI and cooler Core CPI at 3.2% (below expectations) offer some relief, signaling that accelerating inflation risk may be easing.

Yet, with cumulative inflation at 21.2% over the past three years, the Fed can’t celebrate just yet. For markets, this is short-term good news—risk assets rallied on the read. But biotech investors know better than to assume smooth sailing. As one of the most volatile corners of the market, $XBI reminds us that sentiment can swing sharply depending on macro signals.

If unemployment stays under 5% and inflation trends closer to 2.5%, QE becomes the Fed’s most logical tool. Powell’s playbook here is to weaken the dollar while avoiding a surge in housing costs, which make up a big piece of headline inflation. Cutting rates risks spiking the long end of the yield curve if markets price in future inflation, making QE the cleaner option. For biotech—often seen as a barometer for risk appetite—QE could provide some breathing room, but only if inflation stays controlled and unemployment doesn’t spike. Otherwise, $XBI remains a punching bag for jittery markets.

The nightmare scenario? Higher unemployment and sticky inflation. That would leave the Fed stuck, unable to justify rate cuts or lean into QE. For biotech, this would be brutal. Without a clear path to liquidity, capital would dry up, and companies already stretched thin would face even steeper funding challenges. Investors in $XBI would have to brace for more pain as the market prioritizes safer havens.

Complicating matters are external shocks like the LA fires, with damages now estimated at over $250 billion. California’s FAIR insurance plan, with just $700 million in cash and $2.5 billion in reinsurance, isn’t remotely equipped to handle the fallout. Federal relief or QE-style intervention could become necessary, further crowding the Fed’s plate. Biotech Investors should watch unemployment, inflation, and fiscal relief closely—because when macro pressure hits, $XBI always feels it first.

A 2024 Review of Modality Landscapes and Trends

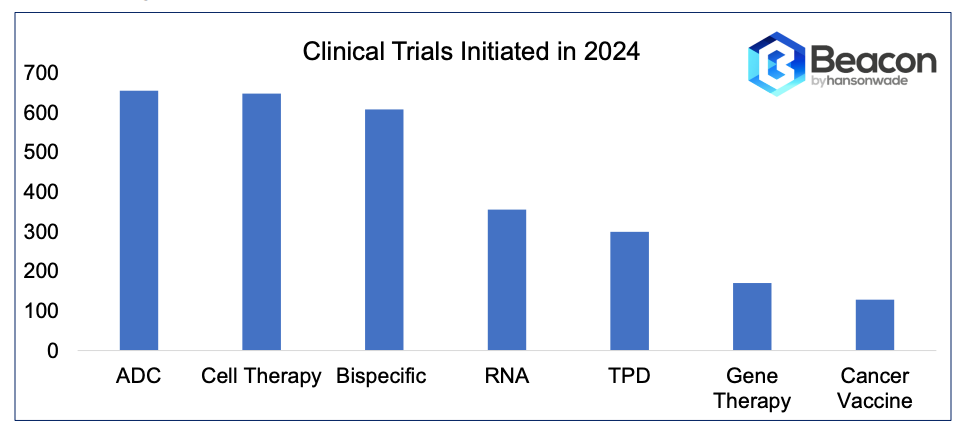

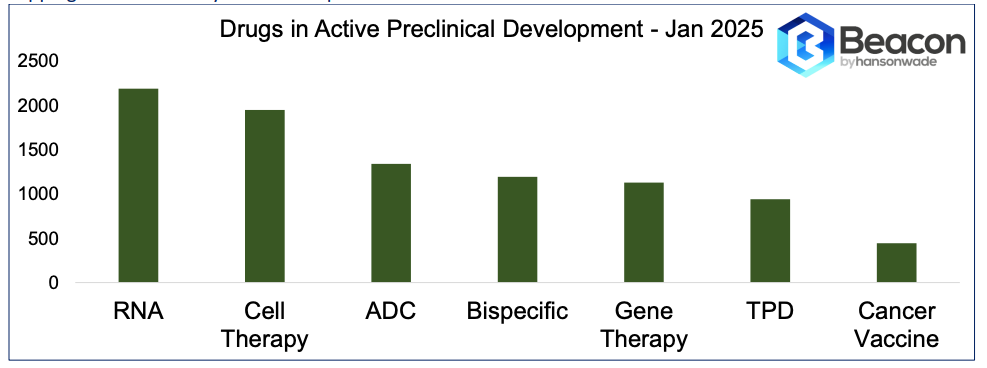

The biotech industry thrives on constant change, and 2024 delivered on innovation. Emerging therapies moved from concepts to clinical breakthroughs, driving progress across antibody-drug conjugates (ADCs), RNA therapeutics, cell therapy, and bispecifics. The competitive landscape grew intense as companies raced to lead these transformative areas. Each modality showcased its potential to reshape the field, blending scientific ingenuity with strategic execution by biotech and pharma leaders.

Today, we’re diving into the year’s most impactful developments, from clinical trial successes to high-profile deals. Beacon data on LinkedIn adds extra depth to this analysis. These milestones not only highlight the bold moves of 2024 but also offer a glimpse into the future, setting the stage for what’s next in 2025 and beyond.

Antibody-Drug Conjugates (ADCs): Booming and Binding

If there was one modality that stole the spotlight in 2024, it was ADCs. The year saw 1,547 trials posting updates, with 379 now in Phase 3. The momentum in the ADC field was fueled by both scientific advancement and strategic corporate activity.

Leading the charge was Johnson & Johnson, whose acquisition of Ambrx Biopharma in January ignited a frenzy of dealmaking. This was followed by Gilead’s partnership with Tubulis in December, cementing 2024 as a banner year for ADC M&A activity. With the technology maturing, ADCs are extending into broader indications, including solid tumors and autoimmune diseases. Companies like Daiichi Sankyo and Seagen/Pfizer remain key players.

RNA Therapeutics: Expanding Horizons

The RNA field continued its robust expansion, bolstered by clinical progress in RNA editing. Notably, Wave Life Sciences made headlines with the first clinical data on ADAR-mediated RNA editing, catalyzing financial and strategic interest in the field.

In 2024, Ionis Pharmaceuticals capped a landmark year with an ASO approval in December. Meanwhile, Borealis Biosciences’ £150M Series A stood out among new company launches. With over 950 new preclinical programs, the space is brimming with activity. Expect players like Moderna, BioNTech, and Alnylam to continue driving innovation.

Cell Therapy: Scaling the Solid Tumor Wall

Cell therapy sustained its growth trajectory, even as market headwinds created pockets of uncertainty. A key highlight was Arsenal Bio’s $325M Series C and BMS’ $380M deal with Cellares. Meanwhile, Adaptimmune’s TCR approval rekindled confidence in the modality’s potential for solid tumors.

However, challenges in the space were underscored by BMS terminating its agreement with Century Therapeutics, reflecting the complexities of aligning scientific promise with commercial viability. Despite setbacks, the field has shown resilience, with companies pushing boundaries to overcome technical and manufacturing hurdles.

One of the most intriguing trends is the repurposing of CAR-T therapies for autoimmune diseases, a move that could redefine the cell therapy landscape. The modality’s adaptability ensures continued interest, with players like Novartis, BMS, and Legend Biotech leading the charge.

Bispecifics: The Versatile Biologic

Bispecific antibodies solidified their place as a cornerstone of biologics in 2024. With over 6,000 new trials, the modality is surging in popularity, especially in autoimmune diseases. Merck’s acquisition of a next-gen CD3xCD19 bispecific antibody from Curon Biopharmaceutical and Novartis’ collaboration with Dren Bio are indicative of the intense interest in well-differentiated bispecifics.

T-cell engagers for autoimmune diseases and innovations like myeloid-engaging bispecifics reflect the space’s depth. A key debate centers around the competition between CAR-T therapies and T-cell engagers (TCEs) for treating autoimmune indications. Open questions persist about the half-life and dosing strategies for TCEs, particularly whether continuous dosing will be required to maintain efficacy. Additionally, concerns exist about whether TCEs can penetrate tissue deeply enough to effectively target autoimmune pathology. Potency is another key differentiator, with CAR-T therapies offering robust responses but facing challenges in managing toxicities. TCEs, meanwhile, must carefully balance their therapeutic index (TI) to avoid off-target effects while still delivering sufficient efficacy.

Georg Schett has been a prominent voice in the debate, particularly through his pioneering work in autogolous CAR-T therapies for lupus. While his studies have shown remarkable success in achieving remission, questions remain about patient selection and the potential variability in remission rates in larger studies. These challenges suggest that the outcomes demonstrated by Schett and colleagues may not fully translate to broader populations, highlighting the need for further research to validate these findings.

By the end of 2025, ongoing clinical data is expected to provide greater clarity on which modality (TCE vs CAR-T) will emerge as the preferred option in autoimmune diseases.

In addition, Capstan Therapeutics is set to initiate a first-in-human mRNA/LNP-based CD19 CAR-T study in the first half of 2025, which could serve as a pivotal data point in evaluating the potential of in-vivo CAR-T approaches. In-vivo CAR-T offers several advantages over traditional approaches, including the elimination of lymphodepletion, enabling redosability, and the potential for outpatient administration. These therapies may also simplify manufacturing and reduce costs by generating CAR-T cells directly within the patient’s body. However, the comparative analysis of in-vivo CAR-T will likely hinge on factors such as safety, durability of response, cost, and scalability, which ongoing trials are expected to clarify.

Emerging Modalities: Gene Therapy, TPD, and Cancer Vaccines

Gene therapy, targeted protein degradation (TPD), and cancer vaccines continue to evolve as modalities of interest. While RNA and ADC dominate, these platforms are steadily building momentum.

Advances in vector engineering and delivery are pushing the field forward. Gene therapy has evolved from targeting monogenic disorders to exploring treatments for more complex diseases, such as neurological and cardiovascular conditions. Companies like Spark Therapeutics and bluebird bio are leading the charge by refining vector designs to enhance safety and transduction efficiency. New delivery systems, including non-viral methods, are gaining traction and could address some limitations of traditional AAV-based approaches. Regulatory and commercial success in this field could unlock life-changing therapies for previously untreatable conditions.

A growing focus on degrader molecules has brought attention to players like Arvinas and Nurix Therapeutics. Targeted protein degradation (TPD) leverages the body’s natural proteolysis pathways to eliminate disease-causing proteins, providing an avenue to address previously undruggable targets. Advances in bifunctional degraders and molecular glues have expanded the scope of TPD applications beyond oncology to include neurological and inflammatory diseases. The field is also exploring strategies to fine-tune selectivity and improve pharmacokinetics, positioning TPD as a transformative modality for precision medicine.

With clinical trials increasing, companies like Moderna are paving the way for next-gen cancer vaccines. These vaccines aim to harness the immune system to recognize and destroy tumor cells by presenting neoantigens specific to individual cancers. The integration of mRNA technology, advanced adjuvants, and personalized approaches has brought renewed optimism to this field. Early clinical data suggests the potential for durable responses, particularly when combined with checkpoint inhibitors. As research progresses, cancer vaccines could become a cornerstone in the fight against cancer, offering patients highly tailored and effective treatments.

CONCLUSION

2024 was a year of milestones across modalities, each showcasing distinct strengths and opportunities. The biotech landscape is more diverse and competitive than ever, with leading companies doubling down on promising modalities to drive innovation and differentiation. As we look ahead, modalities like ADCs, RNA, and bispecifics will likely continue to dominate, while emerging fields like TPD and cancer vaccines mature. For biotech investors and enthusiasts, staying informed on these trends is essential to navigating this dynamic landscape.

We are now publishing 7x per week according to the following cadence:

Mondays: BioBucks: Stock Analysis & Biotech Catalysts

Tuesdays: X-article on biotech hot topics

Wednesdays: Podcast format of X-article

Thursdays: Insiders Track: Public & Private Biotech Markets

Fridays: Sweat Equity: Your Weekly Biotech Fix

Saturdays: Podcast format of Weekly News Update

Sundays: Building Biotech: Strategic Topics

SUBSCRIBE TO PODCAST HERE:

Sundays and Mondays are under the paid umbrella, everything else is FREE. It is $5/month and we encourage you to support our efforts. It is less than 1 cup coffee these days and keeps us motivated to keep producing the hybrid science and business biotech focused content you will not find anywhere else all in the same place.

As a reminder, if looking to go deeper into the topics we cover check out our website BowTiedBiotech.com, or DM us on twitter, or email us: bowtiedbiotech@gmail.com

ABOUT BOWTIEDBIOTECH

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

DISCLAIMER

None of this is to be deemed legal or financial advice of any kind. All updates are sourced from publicly available disclosures. Insights are *opinions* written by an anonymous cartoon/scientist/investor.

TOP BOWTIEDBIOTECH NEWSLETTERS

Hey BowTiedBiotech,

I asked you a while back regarding a dissertation I had to write regarding 'Nanocarriers in Drug Delivery: Are Lipid Nanoparticles the Only Way'. Thank you for your suggestions with regards to looking in to VLPs, it's been very useful.

Just as a follow up, I was looking to do something different to make my dissertation stand out from the others and be a little different. I was thinking of adding a little section to do with economics, biotech investments, etc. Would you know of anything that would link to the particular discussion in my dissertation and various delivery technologies can have an impact on markets? Would you have any articles on your Substack that could highlight some of these examples?