Who's Got the Checkbook Now? | Ep. 707

From Mag7 Meltdown to Biotech Rotation - Where Smart Capital Is Going

Hello Avatar! Welcome to another week of biotech analysis. Today’s commentary is as always on Thursday focused on the general market update. For the week XBI was DOWN -2% and remains red at -8% for the year. This week, we unpack the new architecture of private biotech financing. What used to be a game of valuations, sectors, and momentum has evolved into something much more selective. It’s no longer about who can shout the loudest, it’s about who can build the clearest, leanest, and most milestone-driven story. From Series A resilience to the breakdown in Series B flow, and from fresh fund formation to the reordering of lead investor behavior, every signal points to a market that’s not closed, just recalibrated. If you’re not adapting, you’re already behind.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

We are also publishing unique content on X - be sure to follow up if you are not already @BowTiedBiotech. And to check-out the archive of our work on X you can find it on our website at: BowtiedBiotech.subtack.com/x-articles.

SUBSCRIBE TO PODCAST HERE:

Please help spread the work by subscribing and hitting the share button if you are enjoying content!

Lots to cover this week, let's get started!

BIOTECH PUBLIC MARKET UPDATE

For the week, the public indexes were both DOWN, with the S&P -1% & DOW moving -1%. For the year both remain SPLIT +2% and +0% respectively. The XBI (the biotech index) comes in DOWN -2% for the week and remains -8% for the year.

Macro Update - The Great Unwind Is Here

As we do every week, we find it useful to step back and examine the macro before diving deep into the biotech market.

The most crowded trade in modern investing is being dismantled in real time. Hedge funds are bailing on the Magnificent 7, not trimming, exiting. According to Goldman’s prime brokerage data, their net exposure to Apple, Nvidia, Amazon, and peers is now at five-year lows. This sure looks like structural de-risking. And when institutions liquidate the collateral base of passive equity strategies, it signals something deeper, a shift in the regime, not just the tape.

Why does this matter for biotech? Because duration leadership is up for grabs. The Mag7 once absorbed every marginal dollar chasing long-term growth. With that vacuum forming, capital has to find a new home, and in a world where rate cuts are uncertain and volatility lingers, small-cap healthcare offers asymmetric optionality with defined catalysts. Biotech doesn’t need a Fed pivot. It needs rotation. And that rotation accelerates when the prior leaders break down.

This chart from the Goldman team shows it plainly. The Mag7 long/short ratio has collapsed from 12x in 2020 to under 2x today. Not even COVID, not even 2022 tech carnage, pushed positioning this low. Hedge funds are preparing for duration pain, inflation stickiness, and equity regime fragility. That setup compresses tech multiples and forces capital to seek less-crowded, less-duration-sensitive plays. Biotech, for all its volatility, looks saner by comparison, especially when it’s trading at cash or with near-term data.

The risk? A reversal melt-up.

If AI hype revives or the Fed blinks, funds underweight Mag7 may be forced to chase again, dragging flows right back into large-cap tech.

But until then, biotech stands to benefit. Structural outflows from passive tech heavyweights create room for sector rotation, and with macro uncertainty high, hedge funds are waking up to the idiosyncratic, event-driven nature of clinical trial bets.

The old regime is cracking. Smart capital is already looking for what comes next.

Why Private Market Signals Matter More Than Ever

If you're building in biotech right now, your biggest competition isn’t another startup. It’s the capital allocation math playing out behind closed doors. The public market grabs headlines, but the real decisions, about what gets built, who survives, and what makes it to IPO, are being made in the private trenches. Today’s update confirms what most founders already feel, this market is less about fundraising and more about filtration.

The shift is structural. Fewer investors are leading, more are following, and capital is flowing to fewer names with stronger insider support. The dispersion between haves and have-nots is growing wider by the month. That’s not just a commentary on company quality, it’s a reflection of capital constraints, partner bandwidth, and fear of getting stuck in illiquid rounds with no clear exit.

If you’re raising right now, this isn’t about navigating a tough market. It’s about surviving a structural reset in how conviction is priced, staged, and syndicated. That reset starts at Series A, and falls apart at Series B.

Series A Is Healthy. Series B Is Not.

Series A has rebounded. Proceeds are up 32% quarter over quarter, and deal count rose 18%. Investors are stepping back into early-stage science, betting on cleaner cap tables and unspoiled narratives. The chart below tells the story, 2025 kicked off with $2.3B raised across 20 deals. That’s the healthiest print in over a year. Even if you back out Xaira’s $1B mega-round, momentum is real.

But Series B is moving in the opposite direction. Proceeds fell 35% versus Q4 2024, and deal count slid 18%.

What we are seeing is a systemic hesitancy to fund in-between stories. These are the rounds where clinical timelines stretch, insiders hesitate to reload, and external leads demand cleaner risk-return math.

The “mid-stage trap” is real, too de-risked to pitch as early, too early to be viewed as commercial.

That bifurcation is critical.

The market is rewarding crisp binary risk and punishing clinical ambiguity. For founders, it means Series A isn’t the goal line, it’s the beginning of a high-stakes bridge to Series C that fewer companies are making. You need to raise Series A with your Series B already in mind.

Who’s Still Writing Checks…..and Where

If you’re mapping the market, start with who’s active, and who’s leading. Novo is the standout. They led 7 Series A rounds over the past 12 months and participated in 12 total. In Q1 2025 alone, they led 4. They’re setting the tone for conviction-stage deployment, especially in platform stories and deep biology bets. Forbion and Frazier are close behind, both active and leading with consistency.

OrbiMed remains busy, but they prefer to follow. That matters. Lead investors still determine price, set board dynamics, and anchor syndicates.

In a tight market, followers wait until others commit. That puts even more weight on a small group of funds willing to price risk.

Forbion has become a go-to for founders who need that clarity. They’re showing up across Series A and later-stage deals, leading eight early rounds and eleven beyond Series B in just over a year.

The rest of the landscape is nuanced. Atlas Venture, RA Capital, Versant, and Invus are still active, but their style varies. Some specialize in incubation. Others follow but don’t anchor. A few deploy off-cycle or only around internal spinouts.

If you're raising now, your list shouldn't just include who invested last year, it should focus on who led recently, and who’s leading again in Q1.

The Series B Bottleneck Is Getting Worse

If Series A is where the action is, Series B is where capital goes to stall.

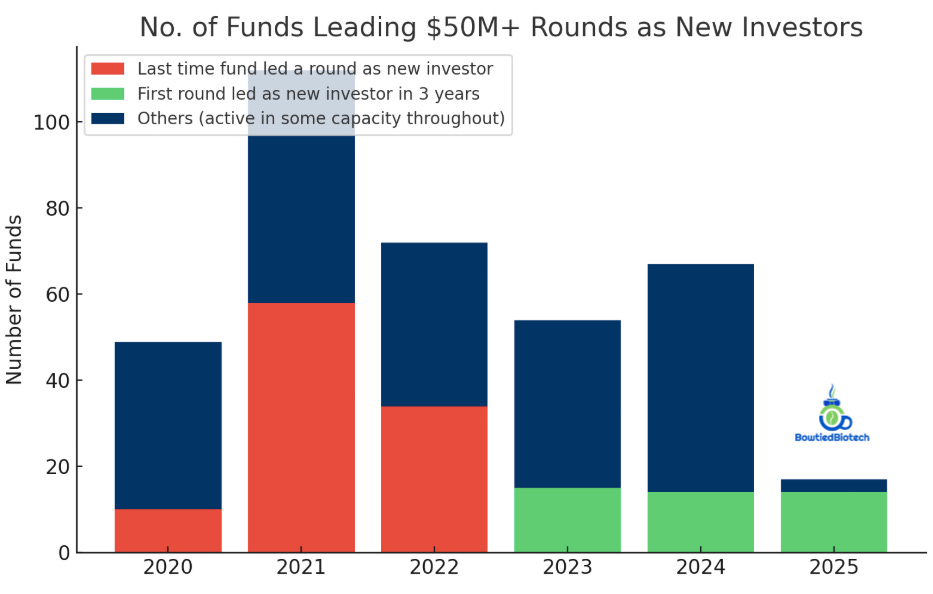

The number of funds leading $50M+ B-and-later rounds has collapsed, only 17 have done so in 2025 so far, compared to 67 in 2024 and a staggering 112 in the 2021 peak. The falloff is brutal. Companies that raised an A in the bull market are now facing the wrong side of duration.

Even among the active, deal behavior has changed. RA Capital, Janus Henderson, Invus, and T. Rowe Price still show up, but they’re largely participating, not leading.

Existing insider rounds, smaller bridge financings, or quiet down rounds dominate.

There’s no appetite for taking fresh clinical risk at bloated Series B valuations without a clean, time-bound catalyst to re-rate the round.

For founders, this means two things. First, if your insiders aren’t willing to step up, external interest will vanish. Second, you can’t assume a Series B will look like the A. You need new data, a new plan, and a new pricing strategy.

New Names Stepping In. Familiar Names Stepping Back.

Some groups are stepping into the vacuum (shown in green below).

Alpha Wave, Braidwell, Commodore, and ICG have re-emerged after being quiet in 2022.

They're not chasing volume, they're deploying surgically into programs where they believe they can own the cap table and shape the story. That’s the new template, fewer rounds, deeper involvement, higher bar.

At the same time, former household names are missing in action. Boxer, Rock Springs, Logos, and Farallon haven’t led a new round since 2022. Some have shifted to public-only strategies. Others are managing outlier risk or fund vintage overhangs. Regardless, they aren’t showing up where founders need them now. The market is creating a new power list in real time.

This reshuffling makes warm intros and prior relationships less valuable. Just because someone led your Series A in 2021 doesn’t mean they’ll touch your B.

Founders need to remap the terrain from scratch, looking at 2024 and 2025 behavior, not 2020 resumes.

Fresh Capital Is Concentrated…And Cautious

Despite the constraints, new funds are still being raised. Blackstone pulled in $1.6B. Sofinnova secured $1.5B. a16z raised $500M. These are not small numbers, but most of that capital is being deployed carefully. Few of these firms are leading new names at Series B. They’re sticking to extensions, insiders, and known platforms.

SV Health, Pillar, and Curie.Bio are also showing up more at the seed and Series A edge, often looking to incubate or co-build.

What’s missing is not money. It’s conviction deployment. There’s dry powder on the sidelines. But the filters are tighter, and most capital allocators need a reason to lead. Not follow.

That changes the way rounds are structured and stories are pitched. You’re not selling a vision, you’re selling downside risk protection.

Founders Need to Navigate This Now, Not Later

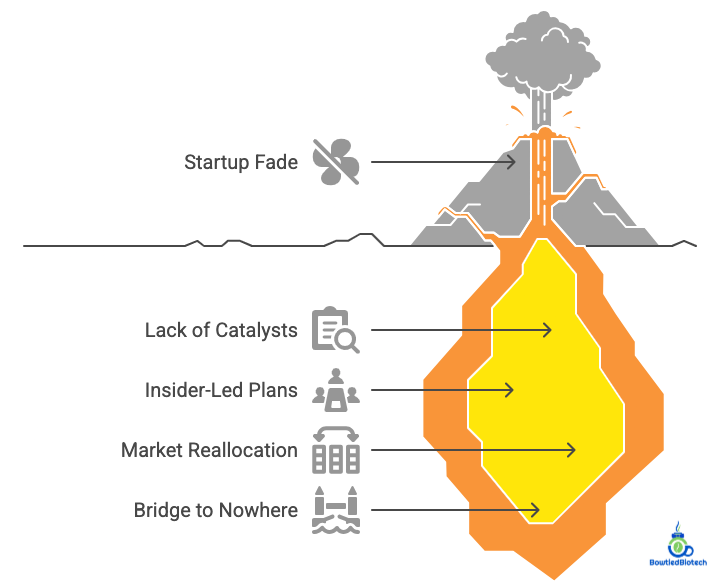

The real threat isn’t capital scarcity. It’s drift. Companies that fail to raise in 2025 don’t implode, they fade. No news, no board decisions, no public closures. Just burn and silence.

Many companies are currently in limbo, funded in 2021, clinical-stage now, and completely unable to generate interest for a crossover or up round.

These are the ones that become reverse merger shells, desperate for survival capital or quietly wound down behind the scenes.

The bridge-to-nowhere dynamic is playing out faster than most realize.

Series B companies without clear catalysts or insider-led plans are already functionally priced out of the next round. It just hasn’t shown up in Crunchbase yet.

The message is simple. Don't wait for a reopening. There is no reopening, only reallocation. Build a bridge that gets to data. Stack your board with doers. And don’t be afraid to pull the plug early if the market tells you the story’s over.

What This Means for the Next Cycle

Today’s update doesn’t just describe the market. It reveals how it’s reorganizing. This is no longer about valuations, sectors, or modalities. It’s about which investors have the stamina, focus, and cash to actually lead. In this environment, the winner isn’t the loudest. It’s the one with the cleanest story and the best-aligned syndicate.

The days of spraying $40M into a five-person team with a slide deck are done. What’s rising in its place is leaner, milestone-driven, data-disciplined biotech. Founders who understand that shift, and build around it, will find capital. Not easily. But predictably.

For everyone else, the message is clear, the private market isn’t closed. It’s just changed. If you adapt early, the capital is still there. But it’s not chasing. It’s choosing.

M&A Radar: Who Fits, Who Buys, and What’s Next

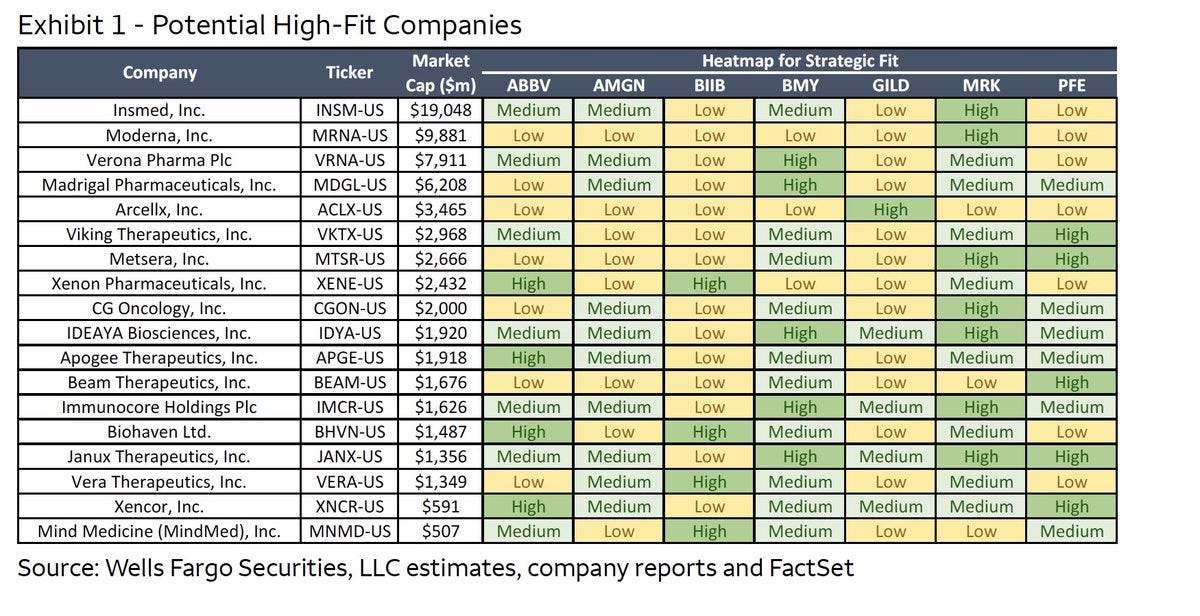

Tom Silver shared a timely chart on X from the Wells team that captures where biotechs may find a strategic home, based on market cap and alignment with Big Pharma priorities.

The heatmap highlights 18 potential high-fit companies across seven buyers (ABBV, AMGN, BIIB, BMY, GILD, MRK, PFE), providing a visual snapshot of the current M&A chessboard.

While some names like $INSM and $MRNA are already well-capitalized, the real intrigue lies in the $1–4B range, where platform progress and Phase 2 de-risking often intersect with acquirers' looming LOE cliffs.

Today, eyes should be on companies that hit two marks: strategic fit across multiple buyers and Phase 2 or later de-risking.

Top of that list:

IDEAYA ($IDYA)

Apogee ($APGE) (we will have a detailed write up Sunday under paid umbrella)

Immunocore ($IMCR)

Janux ($JANX)

All show medium to high fit across five or more pharmas. Notably, $IDYA checks boxes for MRK, PFE, BMY, AMGN, and ABBV, making it a rare overlapping priority.

On the other hand, smaller names like $MNMD and $XNCR may be too niche or early unless paired with bold platform ambitions or CNS-driven resurgence bets.

Bottom line - biopharma M&A isn’t random. Fit is narrowing, buyer overlap matters, and the shopping list is already circulating.

CONCLUSION

Today, we tracked how the private biotech market is reorganizing, not shutting down. We covered the rebound in Series A, the crunch in Series B, and the rise of disciplined fund deployment. We mapped which firms are still leading, who’s stepping back, and what that means for founders navigating 2025. The days of easy money and bloated syndicates are over. What matters now is clarity, capital efficiency, and aligned conviction. If you’re building with those in place, the market is still open. But it’s choosing, not chasing.

We are now publishing 7x per week according to the following cadence:

Mondays: Stocks

Tuesdays: Biotech

Wednesdays: Podcast

Thursdays: Markets

Fridays: News

Saturdays: Podcast

Sundays: Strategy

SUBSCRIBE TO PODCAST HERE:

Sundays and Mondays are under the paid umbrella, everything else is FREE. It is $5/month and we encourage you to support our efforts. It is less than 1 cup coffee these days and keeps us motivated to keep producing the hybrid science and business biotech focused content you will not find anywhere else all in the same place.

As a reminder, if looking to go deeper into the topics we cover check out our website BowTiedBiotech.com, or DM us on twitter, or email us: bowtiedbiotech@gmail.com

ABOUT BOWTIEDBIOTECH

As a reminder, the purpose of the BowTiedBiotech substack is two-fold. Primarily, we aim to provide our scientist audience the tools to build a biotech company and ultimately translate their ideas into medicines for patients. Secondarily, biotech investors may find this substack useful as we will be providing weekly market updates of the public AND private markets as well as heavily leveraging current financing events as teaching examples.

DISCLAIMER

None of this is to be deemed legal or financial advice of any kind. All updates are sourced from publicly available disclosures. Insights are *opinions* written by an anonymous cartoon/scientist/investor.

Is Lilly still leading rounds, or is there focus somewhere else?